Digital banking has had a significant impact on customers and financial institutions (FIs) that continues to be felt today. As digital reliance grows – global spending on digital transformation is expected to hit $3.9 trillion by 2027 – new players are entering the arena and creating products and services that focus on innovation, convenience, security, and resilience.

But what is digital banking exactly? Let’s take a closer look.

Digital banking definition

Digital banking is when customers carry out everyday banking functions via digital platforms by logging in to their account through their bank’s website or app. It uses virtual processes and modern technologies, including mobile phones and laptops.

Digital banking reduces the need for traditional methods – paperwork like pay-in slips, in-person customer service, physical banks, etc. For incumbents, it requires digitizing in-branch products, processes, and activities. Meanwhile, newer market players may have been digital-only from the outset. Digital banking offers many services, including:

- Account and loan management

- Downloadable bank statements

- Transfers

- Opening deposit/savings accounts

- Paying bills

- Checking balances

- Applying for loans/credit cards

- Depositing cheques

Although it isn’t possible to withdraw cash directly, customers still have access to their money using an in-network ATM.

Digital banking provides a convenient and secure way to carry out daily financial activities at the click of a button. Generally, it’s split into two subcategories: online and mobile.

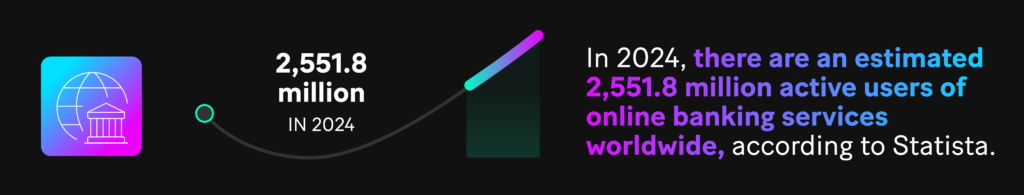

When people bank online, they access features and services via the Internet – in 2024, there are an estimated 2,551.8 million active global users. Mobile banking is a type of online banking that takes place through a mobile app on a smartphone or tablet.

Brief history of digital banking

Early iterations of digital banking go back to the 1960s, with the introduction of ATMs. More modern forms can be traced to the 1990s, and since then, digital banking has accelerated, with Steve Jobs laying the foundations for mobile banking when Apple introduced the first iPhone in 2007.

Fast forward to the present day with the advent of open banking and finance, and the remit of digital banking is expanding, with customers leveraging a broad range of products and services from their bank’s trusted partners.

Who are the major digital banking players?

While legacy or incumbent banks have adapted to offer digital banking services, fintechs and digital-native banks (neobanks or challengers) are ahead of the curve – their business models focus on convenience, security, and frictionless experiences.

Examples of neobanks/challengers include German N26, UK-based Monzo and Revolut, and Brazilian Nubank. Other digital banks making waves include Starling and Chase in the UK, bunq in the Netherlands, Chime in the US, and Trust and KakaoBank in Asia-Pacific.

Benefits of digital banking for consumers

Digital banking has a number of advantages, including making day-to-day financial activities easier, and more streamlined and secure.

Access and convenience

Round-the-clock availability to bank accounts means consumers aren’t beholden to traditional opening hours. They have full control over their finances, because of the advanced features mobile apps offer such as push notification alerts and automated savings tools.

Digital banking is efficient, helping users save time, and thanks to advances in technology, customer service is evolving and improving. According to research by Sopra Steria, Forrester, and Ipsos, “The goal isn’t to replace human advisory with an artificial intelligence (AI) chatbot, but combine AI analysis to create the augmented advisor.”

Moreover, a consumer-first approach is increasingly prevalent – for example, Nubank is “obsessed” with the customer experience, offering support via phone, email, live chat, social media, and FAQs.

Seamless integration

By linking digital accounts with other financial services like e-wallets and payment apps like Venmo, Zelle, Apple Pay, and Google Pay, consumers benefit from even greater convenience. Furthermore, many digital banks integrate with personal finance management tools and budgeting apps.

Competitive rates and lower fees

Because of lower operating costs, digital-native banks can generally offer better rates, lower fees, higher interest rates, more cashback, and more attractive rewards than incumbents. Competition comes into play too, giving consumers attractive choices beyond brick-and-mortar financial institutions.

Security

For many, safety, security, and protection from fraud are paramount when choosing a bank – the trust factor. Digital banks have measures to help prevent threats, including multifactor and biometric authentication, verification of payee tools, temporary card freezing capabilities, timed logouts, data encryption, and more.

Additionally, digital payments and e-wallets are often more secure methods of transferring money than traditional card-based systems.

Financial inclusion

Digital banking encourages financial inclusion, helping level the playing field by reaching unbanked and underbanked communities that rely heavily on mobile phones but may not have access to physical branches. For example, Africa is the globe’s “mobile banking leader”, according to research by the World Economic Forum.

What’s more, the connectivity of the digital age can help increase financial literacy and play a role in social issues like generational wealth gaps and racial inequality. OneUnited Bank launched WiseOne® Insights, a “financial wellness companion”, while Sopra Banking Software has expanded its presence in Africa.

Benefits of digital banking for financial institutions

Digital banking brings myriad consumer benefits, but what about banks themselves?

Digital transformation has turned the global financial sector on its head. For incumbents, embracing digital banking is no longer an option – it’s a necessity. However, digital banking shouldn’t be seen as an existential threat. Instead, it’s an opportunity for traditional banks to gain a competitive edge by harnessing the power of technology like AI, leveraging data analytics, and partnering with innovative fintechs to create hyper-personalized and immersive customer experiences.

Additionally, digital banking brings cost savings. Thanks to the digitization and automation of existing processes, banks need fewer IT and infrastructure resources and back-end processes are more streamlined. At the same time, cloud-native neobanks and challengers have lower costs by their very nature: Estimates reveal they’re 60% to 70% less than a traditional bank.

Challenges that come with digital banking

When incumbents add a digital arm, investment, restructuring, modernization, and cultural issues can prevent a smooth transition. On top of that, there’s the need to appeal to a younger, digital-native generation.

Modernization and mindsets

Traditional banks tend to be deeply siloed and entrenched in legacy systems, meaning transformation can be difficult and is often incremental. That being said, our research revealed that banks “recorded their highest level of digital maturity” since launching our annual DBX survey in 2021.

For banks still on their digitalization journey, there are several modernization options to consider, whether it’s upgrading core systems, migrating to the cloud, adopting a decentralized, microservices model, becoming more tech-focused and data-driven, or a combination. Cost and time come into play here, but the transition is made easier by working with an experienced partner like Sopra Banking Software.

Another important aspect is internal culture – ensuring the C-suite and employees prioritize a collaborative mindset. Progress is occurring on that front, as per our research.

Regulations

When it comes to digital transformation and banking, FIs must consider an array of evolving rules and requirements – for example, the Payment Services Directive revision (PSDR3), the Digital Operational Resilience Act (DORA ), and the Financial Data Access (FIDA) framework, to name just a few. As such, compliance must be built into online and mobile platforms – a challenging task.

What’s next for digital banking?

With consumers searching for more personalization and security, banks must constantly adapt and evolve with new and improved offerings.

Banking-as-a-platform

One way for incumbents to achieve that is via banking-as-a-platform (BaaP) – combining their existing products and services with complementary ones from trusted third parties and offering them through their own channels. With this model, the bank owns the customer journey.

Banking-as-a-service and embedded finance

The inverse of BaaP, banking-as-a-service (BaaS) is a way for FIs to distribute their services and infrastructure through third parties. Here, the bank relinquishes control of the customer journey.

With embedded finance, banks integrate their offering into non-financial platforms such as e-commerce and mobile apps. The concepts overlap but there are differences, particularly when it comes to governance and compliance.

Open banking and open finance

Open banking is a core tenet of digital banking. Using application programming interfaces (APIs) and adopting an ecosystem approach, financial institutions and third parties can connect and share customer data, leveraging it to create innovative products and services.

Open finance is the next stage, covering a broader range of products and services, including pensions, insurance, tax, mortgages, savings, and consumer credit. Regulations like the FIDA are paving the way, aiming to better manage data sharing, encourage collaboration, and level the competitive playing field.

Technology: AI-enabled banking

The continued development of innovative apps and online tools is important, too. Achieving that requires investing in technology like generative AI. Indeed, Sopra Banking Software has seen a “10-fold increase in interest from banks keen to leverage the power of AI”.

Investment is also needed to improve security, because cybercriminals are using artificial intelligence to adapt their tactics, making it a double-edged tool.

ESG compliance

Alongside technology, ESG (environmental, social, and governance) compliance is gathering momentum, with consumers and banks attaching greater importance to sustainable, ethical, and inclusive financial solutions. For example, banking services must be accessible from June 2025, per the European Accessibility Act (EAA).

Moreover, a raft of regulations such as the European Commission’s Corporate Sustainability Reporting Directive (CSRD) covers requirements and disclosures, meaning banks must “adapt their IT systems to systematically collect, aggregate, and report on a broad range of ESG data”.

When thinking about ESG, social banking also plays a part: “Financial services whose main objective is to contribute to the development of people and planet,” per the Institute for Social Banking.

Digital identities and ID wallets

At the same time, digital IDs and wallets are gaining traction – the European Digital Identity (EUDI) Regulation entered into force in May 2024, with full implementation by 2026. Wallets will offer secure authentication, meaning digital banks will find it easier and faster to perform functions like know-your-customer and anti-money laundering checks.

Central Bank Digital Currencies (CBDCs)

Some countries – Jamaica, The Bahamas, and Nigeria – already have a CBDC, and over 100 countries are exploring the concept. When it comes to the digital euro, a two-year preparation phase began in November 2023, so although implementation isn’t imminent, testing and experimentation are in motion.

Aiming to improve payment systems and financial inclusion, CBDCs have the potential to influence the evolution of digital banking, if designed appropriately.

For information on Sopra Banking Software’s API-first, go-to-cloud offering, visit our Digital Banking Suite page.

For more expert content, subscribe to our newsletter or visit our Insights page.