In today’s competitive financial services landscape, customer acquisition and retention is challenging. To place themselves in the strongest position, banks should apply data-driven decision-making and marketing automation techniques, and personalize user journeys as much as possible.

Doing that helps keep banks top of mind and improves engagement with new and existing customers. Additionally, the marketing team saves costs, increases lead generation, and improves conversion rates.

Marketing automation was discussed at the latest Sopra Banking Summit by Laurence Niclosse, Customer Experience Partner at Sopra Steria Next, Nicolas Miachon, Digital Marketing Director at SBS, and Paulin de Boysson, Regional Vice President of Marketing Cloud at Salesforce. We explore some of the highlights below.

Importance of personalization, trust, and security

Every day, the average person is reportedly exposed to between 4,000 and 10,000 adverts. That may well be an overestimate, but regardless, individuals screen out most, only registering less than 100. With that in mind, a brand’s “share of voice” will increase with timely and targeted marketing efforts.

Banks can achieve that through personalization. But according to Nicolas Miachon, it’s “actually very hard,” for several reasons. For example, they deal with an enormous amount of data and many touchpoints – “customer life moments” – some more obvious than others.

There’s also the question of data security and privacy. People trust banks with their money, but aren’t confident they act in their best interests. According to global public relations consultancy firm Edelman, “an organization’s ability to succeed or fail is defined by trust in their mission and leadership”.

Edelman’s 2022 Trust Barometer revealed only 54% of the population trusts the financial services sector (versus 60% for business in general). Indeed, it’s one of the least trusted areas ranked by the public since 2008, with nine out of 13 developed countries distrusting it.

But in the evolving open banking and finance landscape, progress is occurring. For example, per The Economist’s “Banking in 2035: three possible futures” report, “To earn the trust of skeptical customers, big tech and banks partnered to advocate for stricter regulations on consumer and investor protections in the EU and the US.” Furthermore, “Enhanced regulations allowed for increased use of technologies in the financial services industry.”

With banks striving to build trust (and despite lingering concerns), 70-80% of consumers are willing to share their personal and financial data if it benefits them, and 71% expect personalized experiences, with 76% frustrated when that doesn’t happen and 52% saying banking isn’t fun.

Meanwhile, per Salesforce’s State of the Connected Customer report, 80% say “the experience a company provides is as important as its products and services”. With those statistics in mind, banks need to up their game.

Marketing automation and personalization

Marketing automation offers a solution. Going hand in hand with personalization, it requires banks to orchestrate and centralize using a customer relationship management (CRM) system, sequencing, and the right tools – no mean feat considering there are upward of 7,000 on the market.

Given money is a sensitive subject, people expect a specific service that meets their individual needs. According to Laurence Niclosse, “Banks must meet the challenge of mass interaction with the imperative of personalization; without marketing automation, it will be absolutely impossible.”

Paulin de Boysson banks that sentiment up, stating there’s “no future without marketing automation and personalization”. When used effectively, messages and content are pushed at the right time on the best channel. At that point, “I feel understood by my bank,” he says, helping build trust.

Nicolas Miachon also believes marketing automation is the way forward, but only with the “human touch” retained, whether it’s picking up the phone and calling a client from time to time or writing an email. He adds: “Automation is beautiful when it’s invisible,” and advocates using it to streamline back office processes by creating segments for advertising. But with communications, banks should be more discerning.

Future-proofing with three pillars

The benefits of marketing automation are clear in terms of cost savings, lead generation, streamlining operations, enhancing the customer experience, and more, but how can banks make sure they’re ready for the future?

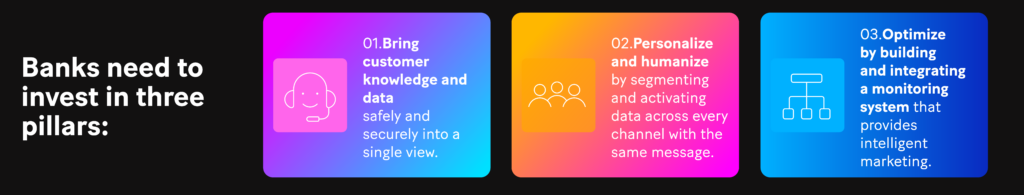

Paulin de Boysson cites a client example: BBVA in Spain. By implementing automation, their marketing teams reduced customer communications by 10, multiplied email conversion rates by four via higher personalization, and in turn, built more trust. To achieve results like that, he believes banks need to invest in three pillars.

- Safely and securely bring customer knowledge and data – the foundation of everything – from often siloed channels and across legacy systems into a single view.

- Personalize and humanize by segmenting and activating data across every channel with the same message, while pushing the right content at the optimal time via the best medium.

- Optimize by building and integrating a monitoring system that provides intelligent marketing, so teams can quickly make the right decisions regarding campaigns and journeys, maximizing marketing investment.

As Laurence Niclosse points out, mastering data must work in conjunction with respecting regulations. She also believes marketing teams need a mindset shift toward focusing on the customer journey and user experience.

Other players like fintechs already have that attitude. However, they start from a different position, with a limited number of products and a small customer base, making comparison difficult. Regardless, they may force banks to act more quickly than they would have done when it comes to marketing automation and personalization.

Key takeaways for chief marketing officers

Succeeding with marketing automation requires a cultural change, with customers placed front and center. As part of that, Nicolas Miachon says banks should avoid automation becoming “a black box,” and instead, stay human and understand AI.

Paulin de Boysson believes “It’s important to design the right path to omnichannel marketing, and there are great partners for that.” On a more disruptive note: “In this era of artificial intelligence (AI), the new equation for banks is to bring data, AI, and their CRM together, and embed with a layer of trust, security, and safety.” By doing that, they can meet customer and profitability goals.

For Laurence Niclosse, banks must be “absolutely clear about the maturity of their marketing team, tools, and ecosystem”. Only then can banks “build a real transformation and operational roadmap to switch to marketing automation”, and fulfill the promise of personalization.

Watch the “Marketing for banks: Retaining continuous attention” session here, and use our free digital banking maturity assessment tool, created in collaboration with Forrester, by clicking here.

If you’d like to delve deeper into the subject of marketing automation, watch our latest webinar by clicking here.

For more expert content, subscribe to our newsletter or visit our Insights page.