Instant account-to-account (A2A) payments are set to accelerate in the European Union over the next ten years, driven by advancements in open banking technology. EU regulatory changes aim to make transfers faster, more secure, and affordable for consumers and merchants.

The shift away from traditional card payments and card-linked wallets in the EU has already begun, with research by Worldpay’s Global Payments Report finding that in 2023 alone, A2A payments accounted for about €487.5 billion, or 18%, of total e-commerce transactions.

It is no surprise that the coming years are expected to be a transformative period for open banking payments, propelled by the EU’s Instant Payments Regulation adopted in February, the Single Payment Area (SPA) Architecture (SPAA), and Payment Services Directive 3 (PSD3).

As explained in the Sopra Steria 2023 Digital Banking Experience Report, this transformation underscores the need for robust collaboration among stakeholders to deliver enhanced value to end-customers, whether individuals or businesses. The report found that more than 4 out of 10 of banks are focused on improving monetization of open banking.

Here, we explore the growing importance of A2A payments in the European Union and how SPAA and PSD3 will shape the future of payments across the 27-member bloc.

A2A payments in Europe: background

A2A payments are powered by open banking and allow consumers to transfer money in seconds, regardless of the time or day, within the same country and also to other EU member states, according to the European Council.

The system also benefits merchants by removing the need for card providers to act as intermediaries, resulting in lower costs, faster settlements, and enhanced security.

A2A payments fall under the EU’s Instant Payment Regulation, which is part of the Capital Markets Union, an economic policy plan launched in 2014. It aims to modernize the 2012 Single Euro Payments Area (SEPA) regulation on standard credit transfers by adding specific provisions for instant credit transfers.

The European Commission says the new rules improve the strategic autonomy of the bloc’s economic and financial sector and reduce excessive reliance on third-country financial institutions and infrastructures.

This has led to A2A payments becoming more mainstream in the EU, particularly in Scandinavian countries such as Finland, Sweden, and Norway. Strong adoption is also being seen in the UK, Germany, the Netherlands, and Poland thanks to their digital payments infrastructure and tech-savvy consumers, according to the Worldpay report.

Despite the EU’s regulatory efforts, Worldpay is forecasting that the open banking-powered A2A payments sector will record modest growth of 19% by 2027, saying there has been slow adoption of open banking protocols to date.

Impact of SPAA and PSD3 on A2A adoption

The two initiatives are highly anticipated and expected to accelerate the adoption of A2A payments in Europe, primarily by lowering barriers to entry for new players and fostering innovation in the sector.

SPAA aims to create a unified payments infrastructure across Europe, fostering interoperability and efficiency. PSD3 seeks to further regulate and modernize the payment services market, as well as enhance consumer protection, such as control over their data, increase competition, and drive the adoption of secure payment solutions.

A recent blog published by the European Payments Council (EPC) notes that SPAA will breathe new life into the European open banking ecosystem as it introduces financial incentives for banks to participate in open banking and help it grow.

The EU already has the main ingredients for a home-grown payments system, the EPC blog adds. This includes low-cost instant credit transfers and open banking that will bring them to merchant checkout screens and add value to consumers’ user experience.

Challenges and opportunities

According to a report by management consulting firm Sia Partners, the EU’s A2A payments landscape faces numerous challenges. These include inconsistent rule implementation across member states and an uneven competitive landscape that could hinder the development of open banking.

The report highlights that banks and financial services companies also face challenges in adapting their legacy systems to meet new authorization and supervision standards, making PSD3 a multifaceted strategic, operational, and technological endeavor.

“Successfully navigating these challenges requires a defined strategy, operational changes, risk assessment, and meticulous execution,” Sia Partners warns.

On the flip side, SPAA has the potential to break down traditional banking monopolies by allowing third-party providers and fintechs to compete on a level playing field, offer value-added services through customer payment account data. But also ensuring that customers stay in control of their data.

The future of A2A payments

The European Council adopted the Instant Payment Regulation in February this year, paving the way for implementation in 2026. This presents a pivotal opportunity for payment stakeholders to proactively prepare for the imminent transformation of the sector.

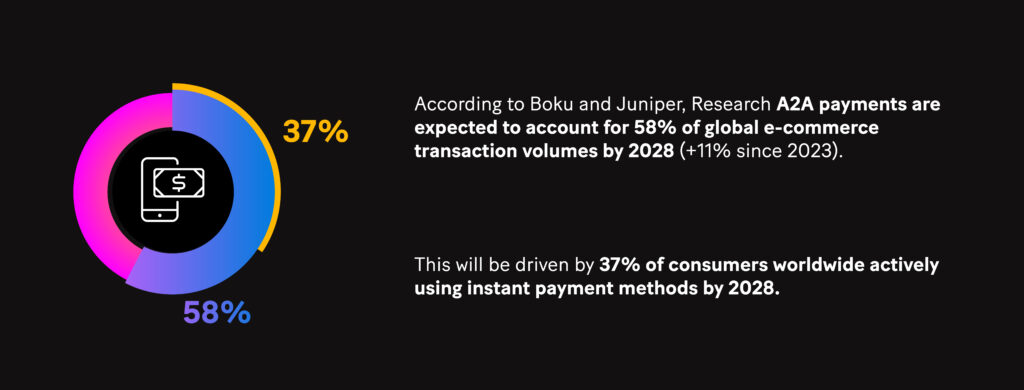

A Boku and Juniper Research survey found that A2A payments are expected to account for 58% of global e-commerce transaction volumes by 2028, an 11% jump from 2023. This will be driven by 37% of consumers worldwide actively using instant payment methods by 2028.

In Europe, the survey found that there will be substantial growth in A2A payments and a decline in card payments.

“This shift in consumer behavior is shaping the present and potentially paving the way for adoption by older demographics,” Boku and Juniper Research said in the report.

Meanwhile, as A2A payments continue to grow in the EU, stakeholders will have to set new standards in order to compete with card schemes and educate consumers on the benefits of instant payments.

According to Juniper Research, open banking-enabled A2A payments will directly challenge card payments across e-commerce in the year ahead, with impact on European markets in particular in 2024.

How Sopra Banking Software can help

The advent of PSD3 and the PSR heralds a crucial evolution in the EU’s Payment Services framework, geared towards addressing the challenges and opportunities of the swiftly evolving digital finance landscape.

Sopra Banking Software provides an Open Banking Platform that covers all regulatory requirements and offers modular services with cloud-native architecture. Our solution is secure at every application and service level and includes, consent management, IBAN name checks, and anti-fraud requirements.

For more expert content on industry outlooks and innovation, subscribe to our newsletter or visit our Insights page.