At a time when consumers are in the spotlight, APIs enable banks to create innovative and personalized customer experiences to differentiate themselves from the competition.

Yet APIs are nothing new. These programming interfaces have existed since the 1980s and became widespread in the 2000s. We use many of them every day without even knowing it. On a smartphone, they enable us to check the weather in several cities. On a flight comparison site, they rank the prices of different airlines to offer us the least expensive options.

In the banking sector, which has been disrupted by the pandemic and advent of open banking, APIs have been thrust to the forefront. Because the competition is getting tougher, financial institutions are pursuing more consumer-centric strategies to meet rising customer expectations. Therefore, APIs have become a crucial tool for banks to reach and serve customers and differentiate themselves from competitors.

APIs are critical to the customer experience

Historically, customers have had little choice in financial services. But Fintech has bucked the trend by providing a product range far superior to traditional options. So it has become essential for banks to react and differentiate themselves by focusing on both the product and the way it is presented. This means that systems need to be constantly improved because the attention is now on the audience, not the product.

That’s where APIs come in. They act as a messenger and connect data, applications, and different software components. They enable the immediate creation of information that is tailored to specific needs. In the financial sector, they give the user access to hyper-personalized services.

Bank-as-a-service = API-as-a-product

However, APIs are not only “middleware” or intermediary software that merely provides a technical link between a service and a developer. APIs vary in nature depending on the product or service they are designed to support. We must, therefore:

- See each one as a product in its own right;

- seek feedback to improve them continuously;

- manage them with a global perspective rather than on a project-by-project basis;

- and start with the needs of the customer to make them developer-specific.

The bank of the future

Unlike a few years ago, when innovation was driven mainly from a technical point of view, the future of banking is no longer based solely on new solutions. It is also about the value the solutions generate for customers. With the Covid-19 crisis, increasing digitalization, and the rise of competition, customer experience has become a key that everyone must reconsider.

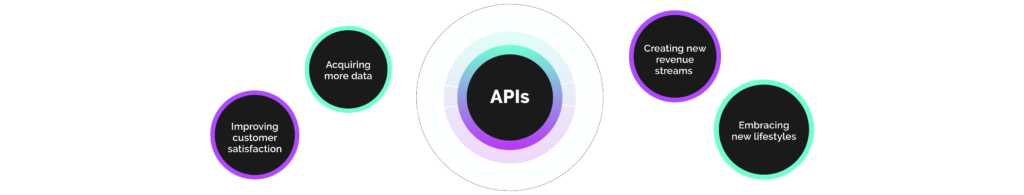

Currently, open banking and its reforms are reshaping the financial landscape. APIs, no longer considered as technical interfaces but as products, are proving to be essential for many use cases. These include:

- Acquiring more data. APIs act as information systems to cross-reference customer data. Banks can determine the best person to lend to and compare contact information for processing applications, etc.

- Improving customer satisfaction. APIs allow the bank to adapt in real-time to customer demands by giving them access to personalized, fast, and seamless experiences.

- Creating new revenue streams and embracing new lifestyles. For example, this can be achieved through data monetization and by offering mobile solutions.

APIs are differentiating tools that change the customer experience and showcase a bank’s identity. They can multiply revenue, boost customer engagement, and make it easier to diversify service offerings.

Risks associated with APIs

The technology behind APIs is not risk-free because it relies on sharing data over public protocols. And as mobile and web applications expand, security must be ensured at all levels.

APIs that connect to applications can be vulnerable to attack, and specific risk analysis, including a focus on security and privacy, should always be part of the approach These security requirements can be a barrier to transformation opportunities if they are not addressed early on. It’s therefore essential that financial organizations integrate three key factors:

- A complete and regular analysis of all their systems;

- Design and implementation of scalable and adaptable real-time tests;

- A plan that ensures the speed at which APIs are introduced to the market does not jeopardize preventive measures, i.e., creating an efficient process while maintaining performance.

As the importance of APIs continues to grow, protecting them has never been more critical. The challenge remains for banks to implement these technologies while ensuring their security at all times.