Retail banking was one of the sectors most affected by Covid. Nation-wide lockdowns, sanitary measures and social distancing shook the day-to-day practice of banking to its core, with brick-and-mortar branches closing and digital demand skyrocketing.

And yet, despite this, there may be a silver lining for the incumbent retail banks moving forward. The impacts caused by Covid-19 have forced them to accelerate their digital transformation strategies, while also damaging many of their challenger bank competitors, therefore levelling the playing field to some degree.

Legacy banks now have an opportunity to become the digital torch bearers for the financial services industry in the years, and perhaps even decades, to come. But it’s an opportunity they have to take now, because it won’t last long.

The decline of digital-only banks

The pandemic, to some degree, hit the reset button for the industry. Before 2020, incumbent banks were somewhat on the run from new, more agile competitors. There are swathes of statistics that highlight the success gained and ground covered by industry entrants during the last decade. Here are three that summarize their success and the reasons that incumbent banks were feeling the heat:

- European challenger banks gained more than 15 million customers between 2011 and 2019

- In a report published in February 2020, just before the pandemic hit, Accenture found that U.K. challenger banks were growing at a rate of 150 percent, year on year, compared to 1 percent by incumbent banks

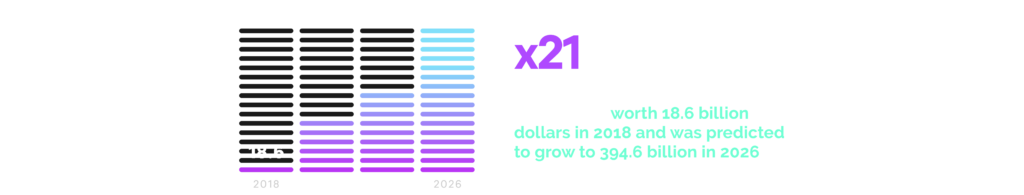

- The global challenger bank market was worth 18.6 billion dollars in 2018 and was predicted to grow to 394.6 billion in 2026

However, 2019 feels like a lifetime ago. Challenger banks and their ilk have taken a massive hit since the beginning of the pandemic. U.K. challenger bank Monzo, for example, laid off hundreds of employees and lost 40 percent of its valuation during the height of the pandemic last year; and others, such as Simple and Moven, called it quits altogether on their consumer activities.

Received wisdom would suggest that customers are more risk averse during risky times, and that even though the traditional banks are not soaring in terms of trust among end consumers, they have emerged as a preferred and stable choice.

Curious, given that challenger banks were supposed to be on the frontline of a digital revolution, and the impact of Covid demanded more digital banking services and bandwidth than ever before. But rather than flock to new digital-only banks during the pandemic, customers instead chose to stick with the traditional industry players.

Digitization of banking services during the pandemic

Risk averse or not, there’s no doubt that customers want – and even need – digital banking services. This was true long before the pandemic, hence the rise of challenger banks last decade. A growing generation of digital-native consumers, a burgeoning digital ecosystem and the availability of new innovative banking products and services all combined to ensure that the future of the financial services industry would be digital.

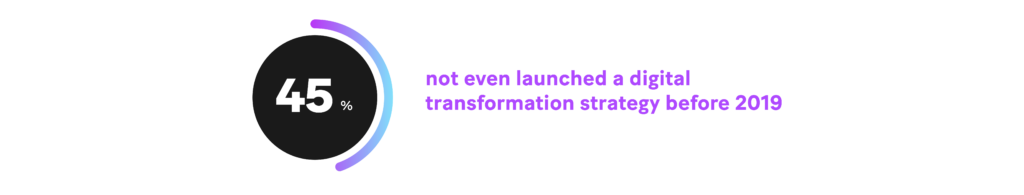

Conversely, traditional banks largely struggled to deal with this exponentially growing trend. Burdened with legacy systems unfit for purpose, rafts of regulations (from which their challenger bank counterparts were largely exempt) and reluctant-to-change cultures, the industry’s incumbents were falling behind fast. Indeed, 45 percent of banks and credit unions had not even launched a digital transformation strategy before 2019, per 2021 research by Cornerstone Advisors.

How things change. Catalyzed by the pandemic, traditional banks – from big names like Bank of America and Chase through to regional incumbents – now boast of how digitally adept they are. In a period of intense digitization, legacy banks have added a host of new and/or improved services, including video KYC, higher contactless payments and chatbot services, just to name a few.

Many of these technologies were in the pipeline for banks before Covid hit, but there’s no doubt that the pandemic accelerated plans. Speaking at the 2020 Bank Governance Leadership Network, one director said: “Suddenly the impossible became possible. Solutions that used to take 18 months to deliver are now happening in 18 days.”

Digital challenges for banks post-Covid

Despite this sudden surge, however, the traditional banks may not have made the progress that the market demands. In some cases, far from it. A deeper look at some of the figures around the current state of legacy banks’ digital transformations makes for somewhat grim reading.

- Approximately 40 percent of banks who state they’re more than half-way through their digital transformation strategies haven’t deployed cloud computing or APIs

- Only a quarter of these banks have implemented chatbot technology

- Just 14 percent have deployed machine learning tools*

It seems that many legacy banks have not made as many inroads into the digital future as some might claim, and certainly not as many as they need to in order to be seen as progressive digital players. That will have to change, as customer expectations are becoming increasingly digital focused, and that’s reflected in their attitude toward banking. Many end-customers expect their banking habits to change over the long term because of Covid.

Worse than the supposed lack of progress, however, is an apparent lack of awareness from some incumbent banks at where they need to be on the digital roadmap. According to the same Cornerstone Advisors study that cites the aforementioned developments, over a third of banks believe they’re more than half-way through their digital transformation.

Incumbent banks have made digital strides during the pandemic, edging closer toward being a bank that appeals to a digital generation of consumers. Suddenly, they’re no longer playing catchup and facing imminent disintermediation across the board, at least not to the same intensity as before.

However, the job isn’t done. One could even argue that because of the ever-evolving nature of digital technology, the job will never be done; rather, digital transformation is a state of constant change and adaptation. For now, though, traditional banks can take a moment to reflect on just how far they’ve come since the beginning of 2020, and pause on what could be considered a sector reset in their favor.

But it’s a moment that should be taken quickly. Technologies will continue to develop, existing challenger banks will regroup and new ones will be launched to challenge the status-quo. Any complacency or naval gazing will quickly see legacy banks lose ground to a new wave of resurgent digital players.

* These figures come from a Cornerstone Advisors study, What’s Going On In Banking 2021: Rebounding From the Pandemic