In the first installment of this series, we looked at the history of green finance, its growth and how financial insitutitions can benefit from going green. In this article, we take a global view of green finance, exploring the steps that key players are taking in going green.

The world is facing a slew of environmental challenges, from deforestation and emissions to pollution. Major stakeholders are rising to these pressing problems and taking action. For example, governments are striving to lower carbon emissions as part of the 2015 Paris Climate Accord – the first universal, legally binding climate change agreement.

Additionally, the public is taking notice of unequivocal scientific evidence highlighting climate change. In a 2019 poll by Ipsos MORI, 37 percent of global citizens cited climate change as one of the primary environmental issues. As consumer awareness has risen, pressure on big businesses and the powers that be has increased.

What’s more, consumers and governments are pushing corporates to respond. Across the entire financial ecosystem, there’s a call for action. For example, green bond issuers are encouraged to conform with EU Green Bond Standard (GBS) requirements. At the same time, central banks are promoting green products.

What do banks need?

Alongside meeting sustainability goals, financial institutions benefit from green finance and investment in other ways. These include risk reduction, attracting young investors and greater profits.

But going green is not straightforward. It requires a flexible and advanced solution that can manage technical challenges. For instance, banks need a system capable of automating complex commercial lending processes. That system must handle multiple currencies, and loan terms across changing regulations and geopolitical situations. A solution that can manage foreign currency loans with numerous funding sources and public-private partnerships is essential, too.

EU leading the way

Recognized as a green policy pioneer, the EU was home to the world’s first major carbon market, making early and bold pledges to cut emissions. The EU is also seeking to become the first climate-neutral continent.

Transparency and integrity are priorities. For example, the European Commission (EC) regulates green bonds with the Green Bond Standard.

The European green finance sector is thriving, with corporate issuers aplenty, including SNCF, Berlin Hyp, Engie and Credit Agricole. In September 2020, Germany raised €6.5 billion from its first-ever green bond – the issuance was five times oversubscribed. Furthermore, the European Central Bank holds around 20 percent of all euro-denominated green debt, despite only buying corporate bonds since 2016.

In July 2020, European leaders took things further, formulating the European Green Deal. The plan aims to transform the EU into a modern, resource-efficient and competitive economy. Implemented successfully, the growth strategy will create a clean, circular economy with biodiversity restored.

As part of the deal, the EC will raise €750 billion to fund the “Next Generation EU” project, an initiative offering grants and loans to help member states recover from the pandemic. EC President Ursula von der Leyen announced green bonds will finance 30 percent of that €750 billion.

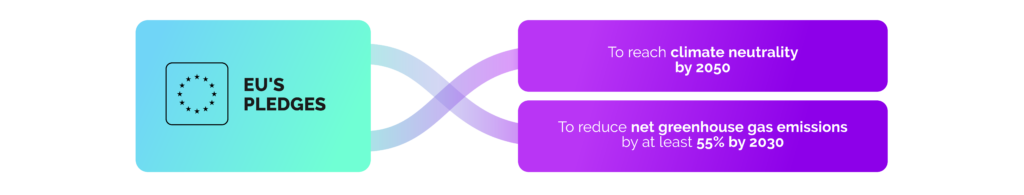

The EC has also proposed a European Climate Law to turn political commitments into legal obligations. For example, the law will enshrine the EU’s pledges to reach climate neutrality by 2050, and reduce net greenhouse gas emissions by at least 55 percent by 2030, compared to 1990 levels.

Keen that no one is left behind, the EU has introduced the Just Transition Mechanism (JTM). The tool provides financial support and technical assistance to regions struggling to go green, ensuring the move to a climate-neutral economy happens fairly. To achieve that, at least €150 billion is being mobilized between 2021 and 2027.

These actions send a strong market signal, indicating Europe’s commitment to its green agenda.

Impending changes in the US

The US may be the world’s second-largest emitter of greenhouse gases after China, but it’s also the top green bond issuer. And recently, there’s been talk of the country issuing its first sovereign green bond.

Ahead of President Biden’s Leaders Summit on Climate in April 2021, lawmakers relaunched the Green New Deal, a set of aggressive climate goals. Initially introduced in 2019, the non-binding resolution aims to eliminate US greenhouse gas emissions within a decade and move the economy away from fossil fuels.

Former President Trump declared war on the “unthinkable” proposal during his time in office. Whether or not the bill passes under Biden remains to be seen.

Regardless, during the climate summit, Biden declared the US aims to reduce emissions by 50-52 percent by 2030, compared to 2005 levels. And he reiterated the country’s commitment to leading a clean energy revolution.

President Biden has made other environmental pledges, too. Just hours after his inauguration, he announced the US would rejoin the 2015 Paris Agreement. He’s also promised to forge ahead with reaching net-zero emissions by 2050 (a much later deadline than the Green New Deal proposes).

Moreover, with Bernie Sanders steering the Budget Committee, there will likely be a push for green initiatives. The progressive statesman believes the climate crisis is the “single greatest challenge”.

Green finance outlook

According to the Global Sustainable Investment Alliance, at least $30.7 trillion of funds are held in green or sustainable investments across the five major markets (Europe, US, Japan, Canada and Australia/New Zealand).

A combination of governments, consumers and the private sector jumping on board the green train has led to action and momentum. As a result, the global green finance market is growing at pace. According to Nordic Bank SEB, 2021 could see more than $1 trillion raised for sustainable financing.

The EU is ahead of the curve, and the future of green finance looks strong.

Is your organization ready to meet the rising demand of green finance? Discover our commercial lending solution, and find out how we can help you to prepare for the future.