If banks and lenders plan to keep up with – or even outperform – the competition, digital transformation of their back office systems is key. The driving force for change is customer experience (CX), a top priority for many financial institutions.

In the past, investment has centered on the front end of CX. However, the back office is an integral part of the larger CX picture that shouldn’t be overlooked. Indeed, the term should perhaps be reimagined and granted greater weight, given the volume and pace of daily interactions dealt with by the back office and the borrower’s controller or treasury department, as well as the profound impact the department has on a lender’s brand.

With people becoming more technologically savvy, the need for first-rate customer experience amplifies. Digitizing back-office operations helps facilitate that.

Alongside rising customer expectations, banks feel pressure from other areas, including tightened regulations and fierce competition. Harnessing technology to digitally transform operations offers an opportunity to improve efficiency, speed up market response time and keep up with new demand.

Commercial lending challenges

Digital transformation for commercial lending doesn’t come without issues. Because legacy systems and mainframes inherited from the 1970s and 1980s are complex and expensive to upgrade or replace, digitizing operations is often neglected.

Yet maintaining legacy back-office systems accounts for 90 percent of technology budgets. On top of that, financial institutions are often unable to change their IT and processes quickly enough.

There’s also the risk factor. Many financial institutions have long-standing human-centric procedures, with manual processes and reviews. Non-core, automatable tasks in the lending lifecycle comprise 30 to 40 percent of time spent. But organizations are reluctant to hand over processes to an automated decision engine.

Dangerous here are the potential implications. For example, failing to fully perfect liens means you can lose collateral, and manual errors in Excel spreadsheets tracking loan balances leads to inaccurate reserve calculations.

Furthermore, limited data analytics hinders a lender’s ability to offer a personalized service, and customers are more willing than ever to switch in favor of more digitally innovative organizations.

Back office transformation

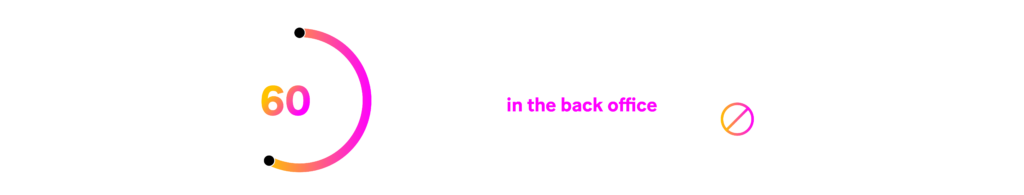

Despite these challenges, commercial lenders shouldn’t be deterred. To improve CX, the front end has seen heavy investment across areas such as portals and mobile apps. Conversely, back-office processes have been somewhat ignored, with manual, paper-based, error-prone and unadaptable processes impacting customer experience. But according to a CapGemini survey, 60 percent of client dissatisfaction originates in the back office.

To keep up with rising customer expectations, the drive for an end-to-end CX solution is forcing back-office transformation in commercial lending. Modern customers require banking services to be reactive, fluid and available. To support that, a complete, robust and digitized solution is crucial.

Additional digital transformation drivers

Alongside customer experience, other factors driving transformation include:

- Fostering client relationships

Developing customer relationships is valuable in commercial banking. To ensure customers don’t go elsewhere, a more streamlined customer experience is vital. After all, the more a borrowing relationship strains the treasury department, the more likely they are to become price sensitive. With fewer error-prone processes, lending personnel are able to spend more time with their clients in the much sought-after role of trusted advisor.

- Enhancing competitiveness

The commercial lending space experienced enormous growth from 2009 to 2015, but financial institutions have struggled to keep pace. To stay ahead of rivals and better serve clients, commercial lenders should strive to eliminate culturally entrenched, inefficient practices. Instead, they should focus on new technologies and weaving them into processes.

- Lower costs

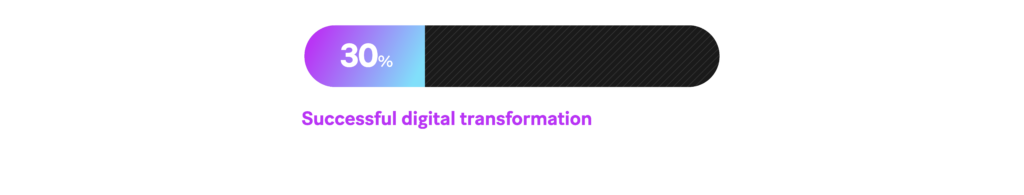

Successful digital transformation of the back office achieves cost savings as high as 30 percent. By utilizing technology and automation, the borrowing process is faster, simpler and more transparent.

In turn, more applications are generated, approvals and disbursements rise, and it’s possible to offer more competitive pricing. Moreover, with less human interaction, efficiency increases, reducing costs further.

Successful automation of the fielding, underwriting, structuring and closing of loans by the “front office” has enabled growth in loan origination without the addition of new personnel.

Historically, that’s not the case across most back offices. But with back-office digitalization, the department transforms into a scale enabler rather than a barrier to growth. Furthermore, the borrower experience improves.

Combined, these factors create the equivalent of a “killer app.” Currently, few institutions capitalize on that value, meaning those adopting back-office digitalization acquire a sustainable competitive advantage.

- Commercial lending complexities

Customer experience for commercial lending is different from retail. Commercial lending involves bigger loan values, more loan diversity, greater deal complexity and, therefore, more complex processes. For instance, a business looking for a $5 million line of credit won’t get a quick yes or no response.

Digital transformation streamlines the customer experience, giving clients a better view of next steps and where they sit in the lending process. Utilizing technology also enables online payments and payoff quotes.

Achieving back-office digital transformation

The “how” is an important question, and there are several methods to consider. Tactical solutions require low levels of investment and involve streamlining basic back-office activities. Strategic fixes such as Business Process Management (BPM) improve efficiency further. And transformational resolutions reach all levels of financial institutions, creating new opportunities to improve customer experience.

Additional back office approaches include:

- Partnering with a technology company for external support to achieve an end-to-end solution

- Consolidating disparate systems used to manage leasing, vendor finance, and commercial lending, creating a unified and flexible platform

- Streamlining portals gained from the acquisition of smaller banks under a single, customizable brand

- Switching to a cloud-based platform to improve scalability, lower costs and increase efficiency, via managed services and hosting infrastructure

- Creating a single platform with a self-service portal, allowing customers to view and manage their commercial lending process and what’s on offer

- Developing and leveraging data analytics, such as machine learning and AI to reimagine and personalize CX

- Introducing event-driven processes, with dashboards offering visibility and lowering risk

It should also be noted that digitization of the back office is not limited to CX transformation. A back office is judged on two main factors: Its functional coverage and its interaction with the ecosystem. Therefore, API catalogue becomes a must-have in order to unlock interfaces and inject flexibility into these peripheral systems – to make them modular and interchangeable.

Back office: Harnessing the power

Technologically minded customers have driven the need for an end-to-end solution across commercial lending – not just during the underwriting and approval process, but every day thereafter over the course of a loan. As part of that, the back office is ripe for digital transformation. The technology is ready to help overcome challenges and digitize operations, creating a streamlined customer experience. It’s not a question of if, but when.

Nor is it a question of why. After all, borrowers saddled with error-prone and productivity-draining processes churn. Those experiencing processes that counsel, inform or delight, stay.

Find out more about how Sopra Banking Software can help you by visiting the Commercial Lending page.