The following post repurposes “It’s time for a different approach to design in financial services” – an article published by cxpartners, a user experience design consultancy and partner of Sopra Banking Software.

We all love how simple online shopping has become. Thanks to slick user interface and experience (UI/UX) and one-click-to-buy options, money is flowing easier than ever. As such, user-friendly purchasing has become the expected norm, and is being increasingly adopted across all industries.

However, while many online purchases are low cost and come with generous return policies – resulting in few cases of buyer’s remorse – there are some that have higher stakes. People are now arguing that for long-term, expensive commitments – like car insurance, for instance – the purchasing process should be more accountable, encouraging the buyer to understand what exactly it is that they’re buying.

It’s a point raised by the Financial Conduct Authority (FCA) in May 2021, with plans to put in place “a higher level of consumer protection in retail financial markets.” But what will this look like in practice? How can banks and financial services firms provide a high-quality, slick customer experience, while also ensuring that their customers are fully aware of what they’re purchasing?

Cost of convenience

Financial products spanning deposit, credit and payment are oftentimes complex. Decisions require research and are hard to reverse once a commitment is made. Subsequently, when design techniques proven to increase convenience are applied to banking-related services, consumers can end up with a poor outcome.

Let’s say, for instance, that a customer applies for a credit card. At the end of the form, there’s a long list of terms and conditions and a check box to tick confirming that the customer understands them. If they’re in a rush and don’t have time to go through the legalese, it’s possible that they may proceed without reading. In fact, a survey by Canary Claims revealed just 30 percent of UK consumers read the T&Cs when signing a financial agreement.

With 2.5 million people in the UK facing financial crisis as a result of COVID-19, it’s as important as ever for people to be prudent with their finances, and for companies to be responsible in minimizing risk and offering better customer protection.

FCA and the ‘Consumer Duty’

The FCA is helping to combat the issue of better customer protection, with its proposed new Consumer Duty – an expanded set of rules and principles to make sure “firms provide a higher level of consumer protection consistently which will enable consumers to get good outcomes.”

Aiming to ensure products and services are clearly presented, fit for purpose and represent fair value, the package of measures will have three key elements:

- The Consumer Principle. Overall standards, whereby a firm must act in the best interest of retail clients to deliver good outcomes

- Cross-cutting rules. Key behaviors for financial institutions to follow, including acting in good faith, taking reasonable steps to avoid harm to consumers and enabling customers to pursue their financial objectives

- Detailed expectations for firms’ conduct. A set of rules and guidance in relation to communications, products and services, customer service, and price and value.

Currently in the consultation phase, new rules are expected by the end of July 2022. Financial institutions will have to follow the Duty or face regulatory action, requiring shifts in culture and behavior for many financial organizations. As part of that, firms must adopt a more customer-centric approach to how they design their products.

Design for longer-term outcomes

Designing financial products and services that help people make more considered and informed decisions is a win-win situation: consumers end up with an appropriate product they’re comfortable with, while providers increase conversion levels and build a loyal customer base.

Achieving this, however, requires a fundamental shift in the industry mindset. It means moving away from the “don’t make me think” style that most UX follows, and instead adopting a true customer-centric approach.

In doing so, companies will need to think about the product from the customer’s viewpoint, perhaps more so than they have done before. This would mean disclosing the “negative” sides of products, coupled with a willingness to help customers avoid making decisions they may regret.

Getting an inside track on the consumer’s decision-making process requires specialist research skills, which helps firms to understand how people in challenging situations behave, plus the ability to build stakeholder confidence in user experiences that go against the perceived design norm.

Case study

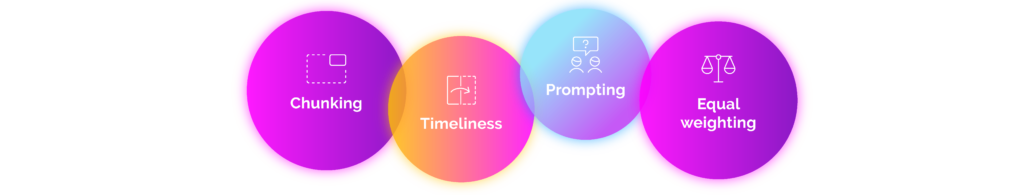

At cxpartners, we applied this design thinking to an online journey, helping customers understand important differences between types of financing products. Instead of asking people to compare a set of options, the UI helps them better understand their needs, then reveals which products map most closely. Details to get right and iterate include:

- Chunking. Bite-sized blocks of content are easier to engage with and process, particularly with complicated information – an inherent characteristic of many financial products

- Timeliness. Pushing information into a later step simplifies the interface but hinders the decision, because it relies on people using their working memory. So, chunk carefully by surfacing relevant content at the point of need, reducing cognitive load to make decision-making easier

- Prompting. Don’t simply ask, “Do you need this feature?” Instead, use positive friction by asking questions that make consumers reflect on their situation, nudging them to consider their needs more deeply

- Equal weighting. Smart default settings and primary calls-to-action aren’t always the right way to go. As an alternative, make consumers choose between equally-weighted options, encouraging them to consider the pros and cons of each.

Our research exposed a few key points. Firstly, customers making a complicated financial decision develop a sense of ease from understanding the product. A learning experience that’s easy to work through, makes people think about previously unconsidered questions and reduces mental effort are key factors. On top of that, inclusive design is vital – building interfaces that cater for a variety of needs makes decision-making simpler for everyone.

Empowering consumers through these design principles strengthens understanding and trust, building confidence and increasing engagement.

Embracing customer centricity

With the expanded regulations likely to come into force in 2022, it’s time for firms to start shifting their approach, ensuring that customer-first outcomes are central to their decision-making processes.

For some companies, this could mean a top-to-bottom shift in how they operate, where customer experience isn’t simply left to designers, but it’s factored into the whole approach, from start to finish. Such shifts will be crucial for those firms wishing to thrive in the coming years.

Indeed, for consumers and companies alike, this type of shift has been a long-time coming, and could be beneficial for everyone.