Do these market challenges seem familiar?

Reduced product margins

Providers are being forced to compete on price to attract new customers.

Dwindling broker loyalty

Complex processes are frustrating brokers and impacting case volumes.

Competitive threat

More agile fintechs are disrupting the mortgage space.

Increased customer expectations

Customers expect faster processing times and more intuitive portals.

Fragmented processes

Disparate systems and processes are frustrating staff and customers.

Painful integrations

Delays in mortgage approvals caused by systems that don’t easily integrate with 3rd parties.

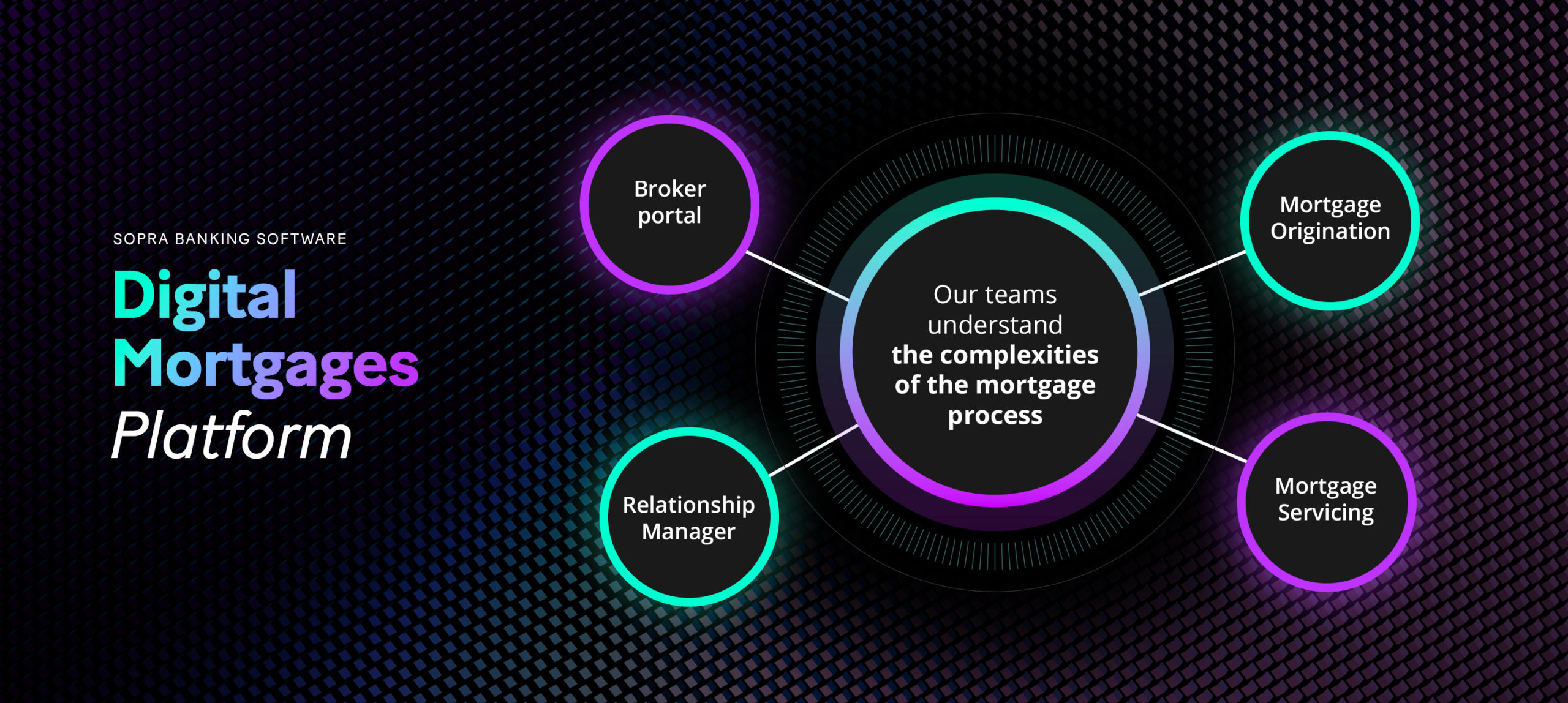

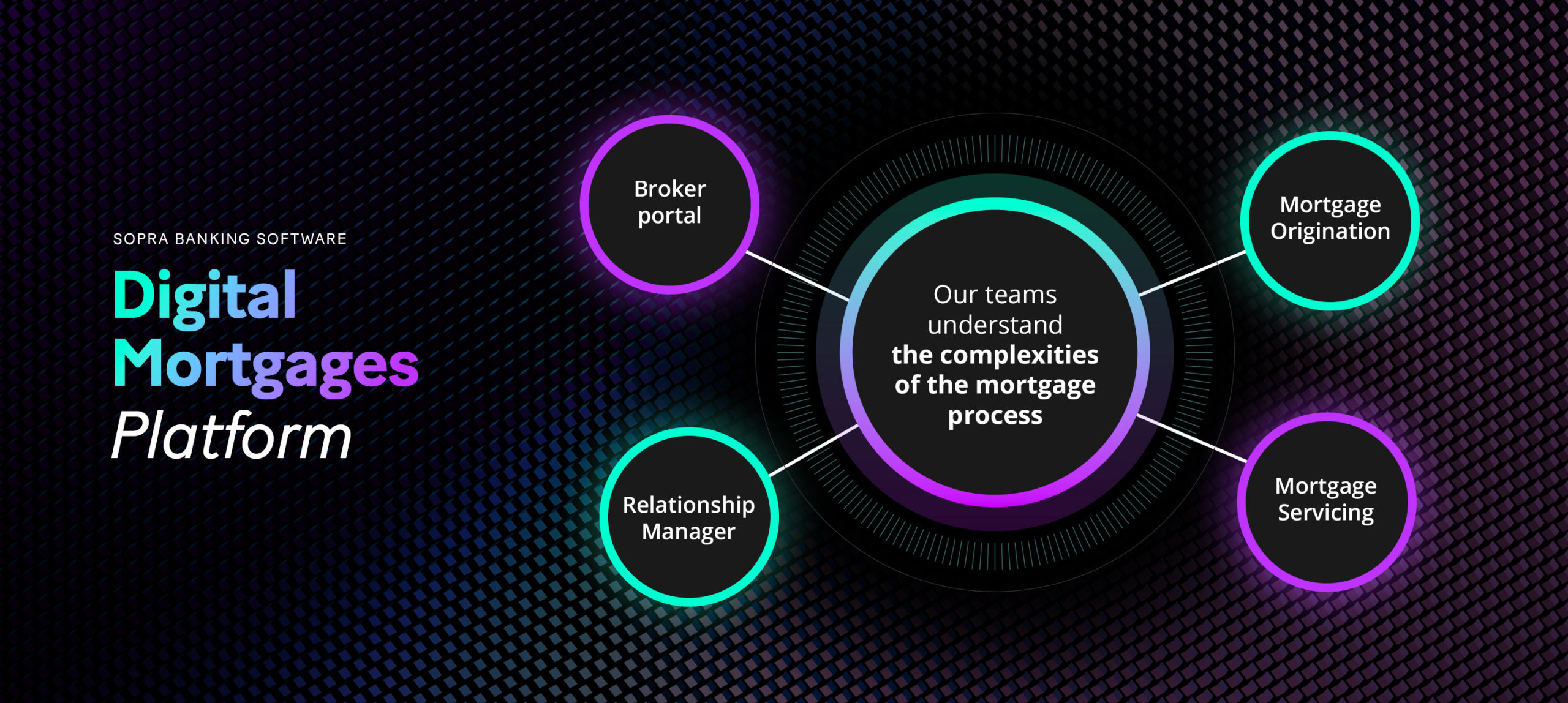

Why choose Sopra Banking Software?

Mortgage specialists

Delivered by local mortgage experts with a proven track record of successful implementations.

Scalable solution

Deploy locally and scale globally. A flexible mortgage platform that can meet existing and future demands.

Rapid benefits realization

Delight senior stakeholders by delivering measurable results from day one.

Reduce operating costs

Automate manual tasks, optimize workflows and boost productivity.

Accelerate decisions

Benefit from the native integration with Experian, Equifax and nine third party agencies.

Drive innovations

Leverage technology and empower employees to create bespoke experiences.