Ipsos European Public Affairs has just released the results of their EU-wide survey on financial literacy. From what to consider when opening a bank account, to mortgage types, how to avoid debt, invest money and save for retirement, to even fending off fraud and cyber risks — financial literacy is a vital ingredient when making sound financial decisions.

With only 18% of EU citizens displaying high levels of financial literacy, the Eurobarometer highlights where we should be focusing our attention to empower EU nationals to make more informed financial decisions. Of all of the valuable insights presented in the report, the most poignant findings demonstrate that financial literacy is especially lacking within several key groups: women, younger generations, those from lower income households along with those possessing lower levels of general education.

It is vital that we invest in financial education for these individuals, who are generally less financially literate than other groups included in the study (i.e. men, older generations, those possessing higher levels of education or from more well-to-do households).

Key findings on financial literacy

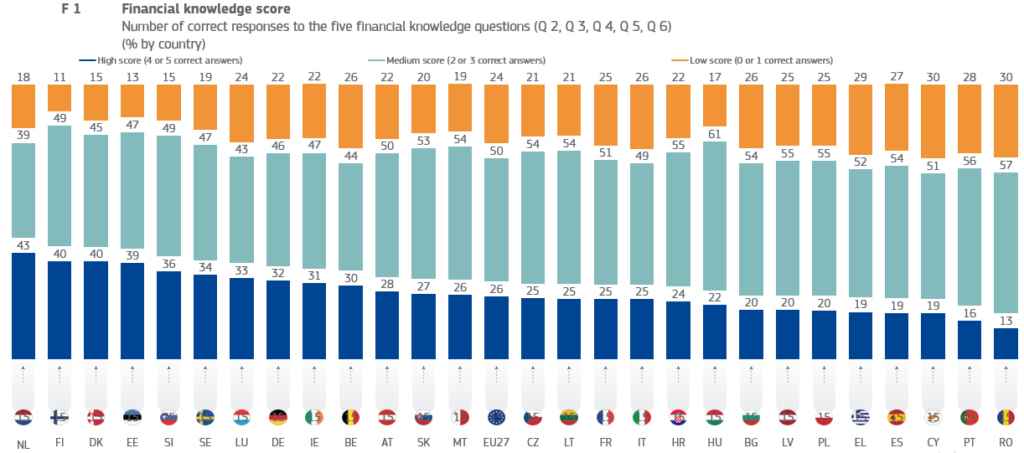

Of all of the respondents, only about 25% were able to answer at least four out of five questions on financial knowledge, correctly. Around 50% answered two or three questions correctly, with the remaining 25% answering either none or just a single question out of the five, correctly. This is particularly alarming, as basic financial knowledge is essential in order to correctly manage one’s personal finances. The countries illustrating the greatest financial literacy were the Netherlands, Denmark, Finland and Estonia.

In regards to financial knowledge, 52% of respondents believe their overall knowledge to be average compared to others in their country. This contrasts the 25% who rate their financial knowledge as ‘quite high’ and 5% as ‘very high’, while 12% believe their knowledge to be ‘quite low’ or the 4% who deem it as ‘very low’ when compared to others in their country.

It might surprise you which countries view themselves in higher or lesser regard in terms of this financial knowledge: 51% of Romania respondents believe their overall knowledge about financial matters to be ‘very high’ or ‘quite high’. They are followed by France (42%), Poland (40%) and Finland (39%), believing their financial knowledge to be either ‘very high’ or ‘quite high’. Compare this with Portugal (16%), Italy (18%) and Austria (18%) where far less citizens view their financial knowledge in high regard.

Financial behavior

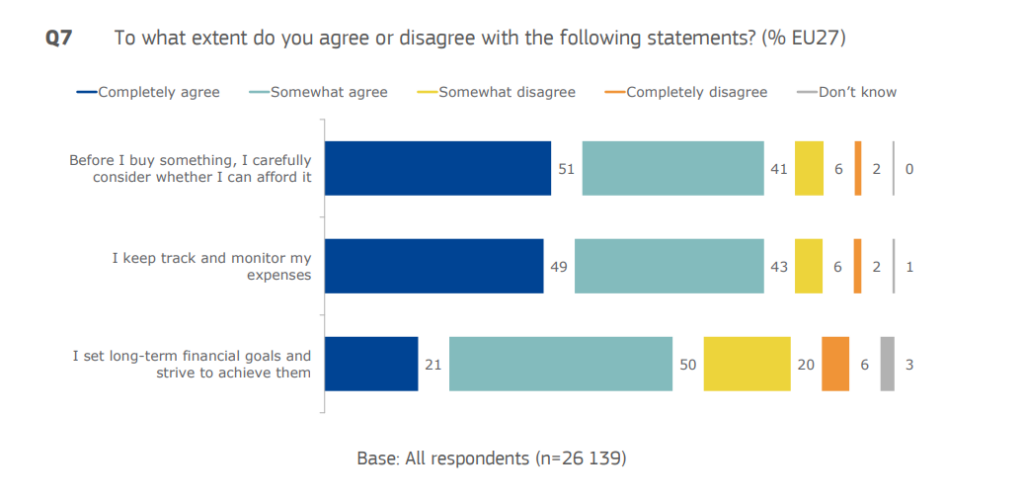

Do you consider whether you can afford something before you buy it? If you answered yes, roughly nine out of ten EU respondents would agree with you (51% ‘completely agree’ and 41% ‘somewhat agree’). Regarding keeping track as well as monitoring their expenses, 49% ‘completely agree’ and 43% ‘somewhat agree’. A further seven out of ten respondents set long-term financial goals and attempt to achieve them (21% ‘completely agree’ and 50% ‘somewhat agree’). When we add up a number of these ‘financially savvy’ behaviors, we get something called the financial behavior score. Romania is at the top with 82% of respondents having a high financial behavior score, while Finland is the lowest with just 36%.

Digital financial services

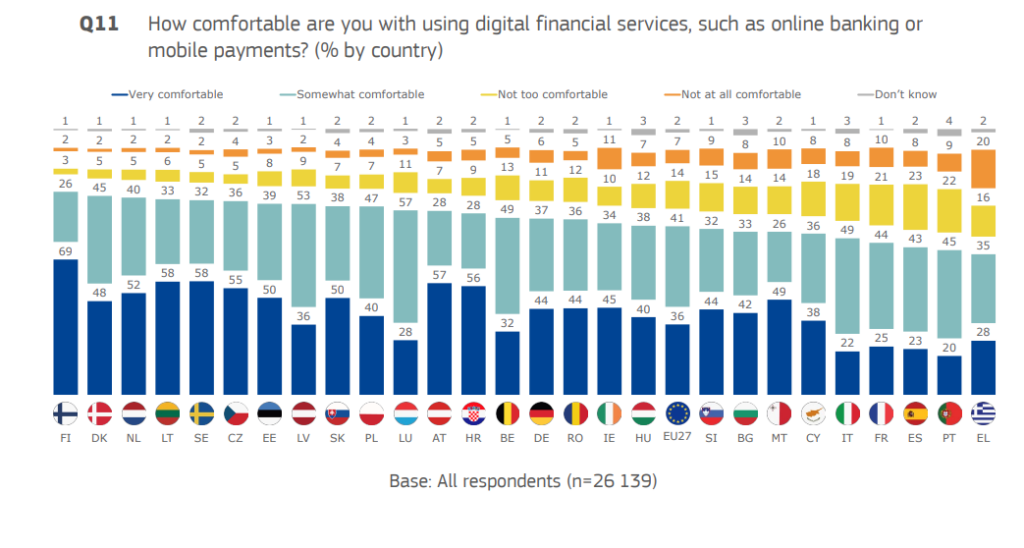

In regards to being comfortable using digital financial services (i.e. online banking or mobile payments), 36% of respondents were ‘very comfortable’ and 41% ‘somewhat comfortable’. In all EU member states this figure was over 60%, with Finland being the most digitally savvy with 95% of respondents indicating being comfortable using digital financial services, while Greece was the lowest with 63%.

Investment advice received from a bank, insurer or financial advisor

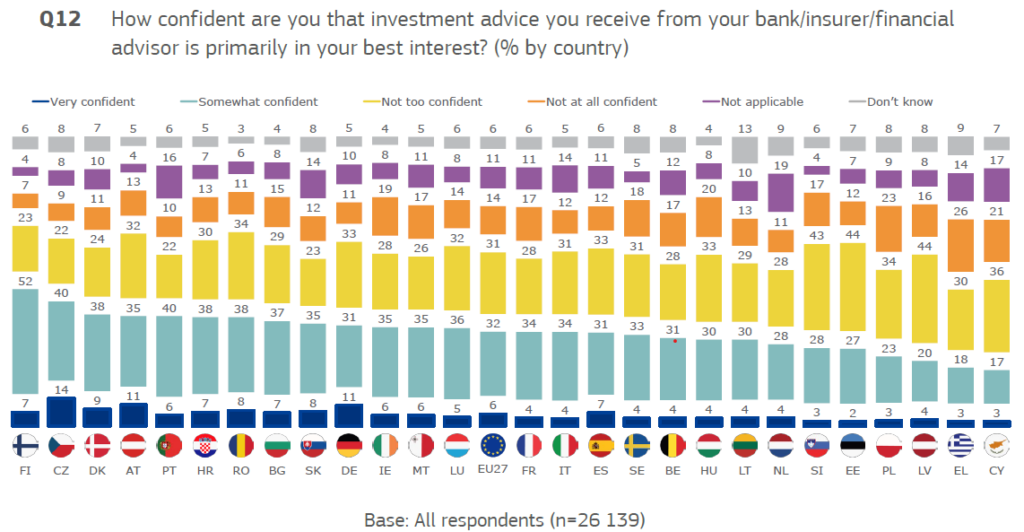

When it comes to investment advice, data shows that trust is severely lacking in the EU. Only about one in three Europeans trusts the investment advice they receive. To put it in perspective, 38% of EU respondents indicated they trust the investment advice received from their bank, insurer or financial advisor — stipulating they were ‘very confident’ or ‘somewhat confident’ that the advice received was in their best interest. This contrasts the 45% who claim to not trust this advice at all. Interestingly, this level of trust differs extensively depending on the nation in question. For example, those citizens from Finland (59%), Czechia (54%), Denmark (47%) exhibit greater trust than those from Cyprus (20%), Greece (21%) and Latvia (24%).

Financial resilience and inclusion

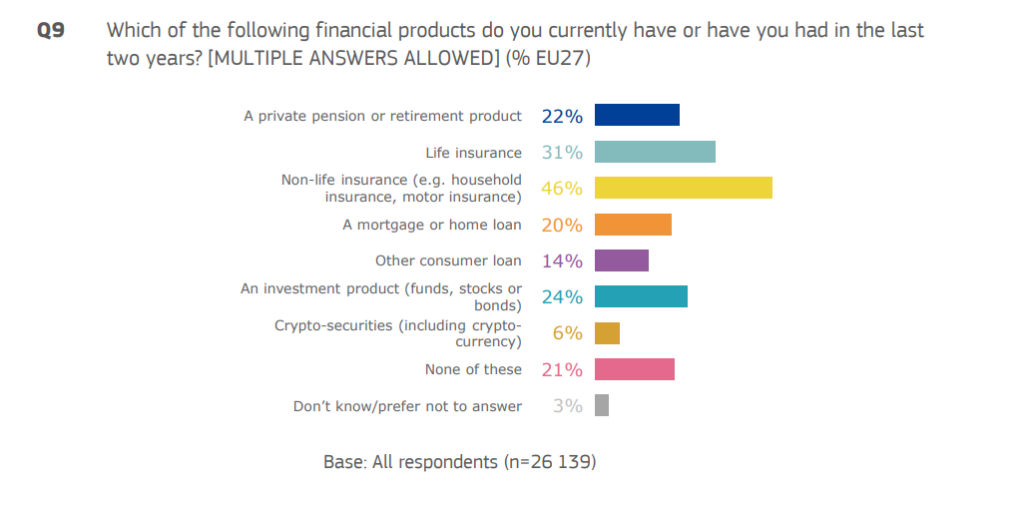

Insurance is a rather popular safetynet for many Europeans, with 46% indicating they have (or in the past two years) a type of insurance other than household insurance or motor insurance. 31% indicated they currently (or in the past two years) have had life insurance.

Regarding nation specifics – this ranged from 16% in Greece to 58% in Poland in regards to having life insurance (now or in the past two years). In terms of non-life insurance (i.e. household or motor insurance), this ranged from 30% in Greece and Croatia to 67% in Denmark.

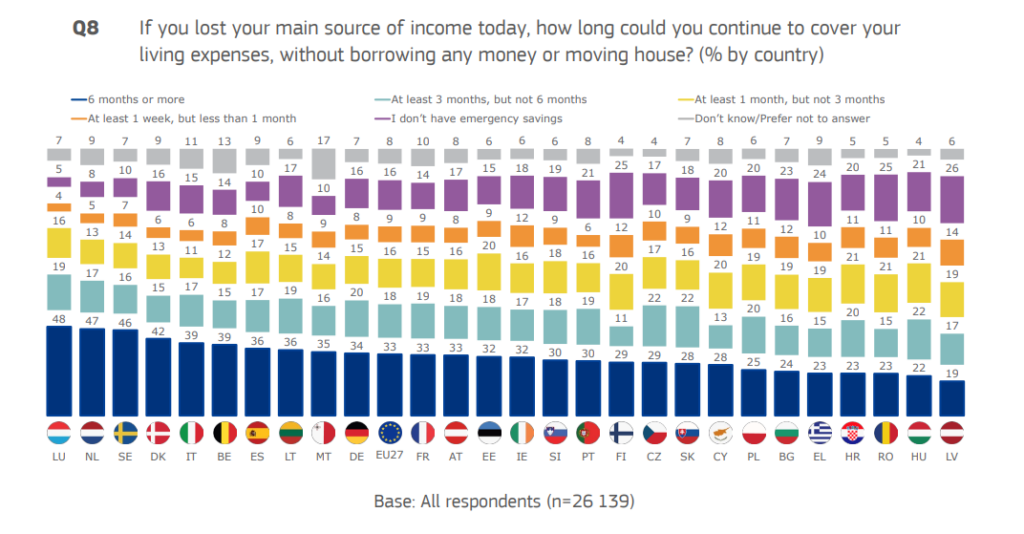

The length of time individuals would be able to cover their living expenses, without having to borrow or move in the event their current income would cease, is incredibly eye opening. Just one third of respondents (33%) would be able to continue for six months or more, with 18% stating they could cover between three and six months, and 16% indicated a lack of any emergency savings.

The countries scoring highest for being able to cover their expenses for six months or more were Sweden (46%), the Netherlands (47%) and Luxembourg (48%). The lowest were Latvia (19%), Hungary (22%), and Romania, Croatia and Greece (23%).

Moreover, more than half of all EU respondents are either ‘not too confident’ (32%) or ‘not confident at all’ (22%) in their ability to live comfortably throughout their retirement years. There is a great deal of variation when it comes to feeling confident (includes ‘very’ and ‘somewhat confident’) — on the low end we have confidence levels of 20% in Poland, compared with 62% on the high end in the Netherlands.

The future of EU financial literacy

When computing a nation’s overall financial literacy score for this study , both financial knowledge and financial behaviour received equal weight. Looking at the EU average, around 18% received a high score for their overall level of financial literacy, 64% a medium score and 18% a low score. The lowest levels of financial literacy were found in Finland (27%), Latvia (24%), Belgium (22%) and Spain (22%), while the highest levels were found in the Netherlands (28%), along with Denmark, Slovenia and Sweden at 27%. With so much variation in the level of financial knowledge across the EU, the evidence indicates that work needs to be done to improve these figures across the board.

The EU remains focused on empowering its residents, by taking the necessary actions to ensure individuals are equipped with the right knowledge, skills and attitudes needed to make solid financial decisions. While it’s important to further educate all EU citizens on financial literacy, it’s clear that extra attention should be paid to those groups with lower levels of financial literacy (women, younger generations, those from lower income households along with those possessing lower levels of general education), in order to foster a higher level of individual financial wellbeing. With consistent efforts however, it is very possible for the financial literacy across all groups and nations within the EU to be improved.

For more expert content on industry outlooks and innovation, subscribe to our newsletter or visit our Insights page.