There’s no doubt about it – open banking is a high priority for banks and financial services organizations. The financial services industry is embracing the movement, with 71% of executives feeling positive about open banking in 2021 – up from 55% in 2019.

However, many banks still struggle with open banking, lagging behind incumbent competitors, challenger banks and neobanks. Working with an experienced software provider can help, offering an effective way to become fully compliant with open banking’s regulatory requirements.

The rise of open banking

This January marked four years of Payment Services Directive Two (PSD2), the legislation designed to facilitate open banking and make payments more secure. Changing the banking landscape in Europe and the UK forever, it sought to level the playing field for all participants.

A means to an end for digital transformation goals, open banking enhances the customer experience (CX), facilitates the launch of new online services and opens up revenue-generating opportunities.

In 2020, Europe had approximately 12.2 million open banking users; that figure is set to reach 63.8 million by 2024. In conjunction with that, registered third-party providers (TPPs) across the UK and the European Economic Area (EEA) have grown from 450 at the end of 2020 to 529 at the start of 2022.

And open banking is set to continue its meteoric rise. Worldwide users are expected to hit 132.2 million by 2024 – there are calls from financial institutions, regulators and consumers for its scope to broaden.

All this means that banks and financial institutions need to be ready to embrace open banking to the fullest if they’re to take advantage of all the benefits it brings – as well as staying on track with the competition.

The benefits of open banking

Because of its omnichannel approach, open banking encourages cross-company collaboration. By partnering with specialist third parties to build a digital ecosystem and harness the power of data, banks are more innovative and competitive. As a result, they offer a more personalized CX, fostering satisfaction and loyalty. At the same time, customers have easy and fast access to a broader choice of products, tailored to their needs.

Moreover, opening banking was designed with transparency and consumers’ data security at its heart. As secure as online banking, application programming interfaces (APIs) are subject to extensive testing, and the customer is the only person who can authorize a connection between their bank and a regulated third party.

Open banking and compliance

Despite everything that open banking brings, some banks are culturally behind the curve: reluctant to change, risk-averse and unwilling to fully embrace partners.

On top of that, keeping up to date with the latest compliance standards is challenging; ever-evolving areas to monitor include regulatory reporting, customer authentication requirements and TPP verification.

For example, adhering to PSD2, the EC endorses additional rulings such as the Regulatory Technical Standards and Berlin Group’s NextGenPSD2. And even though the UK wasn’t obliged to follow PSD2 to the letter post-Brexit, the directive was used as a foundation, with oversight and governance regulated by the FCA.

More recently, open banking in the UK is in the throes of organizational change. March 2022 saw the Competition and Markets Authority publish recommendations for the future, including the creation of a Joint Regulatory Oversight Committee, co-led by the FCA and the Payment Systems Regulator. Additionally, the Open Banking Implementation Entity – responsible for defining the UK’s customer experience guidelines (CEG) – will transition into a new body.

If banks don’t keep on top of changes like these, as well as the intricacies of the standards they comply with, they risk following outdated procedures.

The way forward: Working with an experienced software provider

None of this will come as news to banks and financial services organizations, who are aware of the key role that open banking will continue to play in the coming years. Indeed, per research conducted by Sopra Steria and Forrester Consulting, investing in improved APIs to connect to partners digitally is a priority initiative for over a quarter of banks.

However, the question for many is how exactly to go about ensuring they’re open banking compliant. Plenty of organizations – especially large banks – have attempted to go alone and build an open banking compliance solution in-house. And many of these banks have struggled in doing so. Because of their lack of experience when it comes to software building, they often fail to create a solution that can push on innovation and provide smooth, seamless CX to end-consumers.

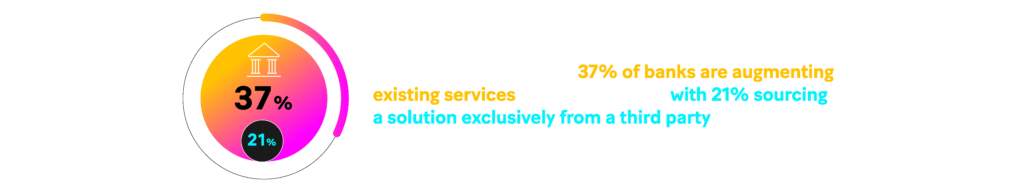

On the other hand, our research shows that 37% of banks are augmenting existing services with a third party, with 21% sourcing a solution exclusively from a third party. Experience shows that such an approach is preferable. By relying on the specialized expertise of a trusted partner, banks and financial services organizations are able to leverage a tried-and-tested solution, and the experience that comes with that.

Sopra Banking’s solution

Sopra Banking’s EU and UK compliant solution covers all of the issues mentioned above, including strong customer authentication (SCA), customer secure communication (CSC) and TPP authorization management, ensuring robust security. Furthermore, our tech-forward solution is easy to deploy, and end-users enjoy a fast and seamless customer experience.

By working with specialist TPPs and experienced software providers like Sopra Banking, banks and financial services organizations can offer innovative and personalized services while ensuring compliance and security. Better yet, they can rest assured that their experienced partner is managing all open banking compliance issues, so that they can focus on what they do best, which is delivering the best possible customer service.