In an age where customer experience (CX) is king, banks are turning to Big Data to help them create the best customer journey possible. It’s now not simply desired, but expected that the banking sector offers customers a seamless, end-to-end humanized digital experience, built on trust and engagement.

But competition remains fierce, and open banking is only forcing banks to work harder to attract and retain end-customers. The good news? Banks already have all of the data they need – they just need to utilize it properly.

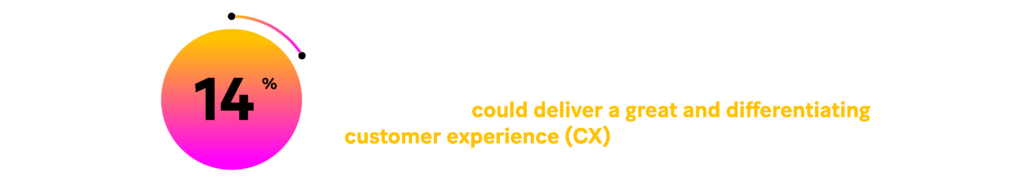

The problem is, however, leveraging this data. Our Digital Banking Experience Report revealed that only 14% of top decision makers at banks, believe that organization’s technology infrastructure and applications could deliver a great and differentiating customer experience (CX).

And with customer expectations changing at a constant and rapid rate, compounded with the ever-present threat of disintermediation by new industry entrants, banks need an effective strategy to turn data into compelling insights, and ultimately cutting-edge products and services.

The role of data in today’s banking

In almost any industry nowadays, data is a vital tool. It can be used to better understand customers, including their wants and needs. According to McKinsey, “Data-driven organizations are 23 times more likely to acquire customers, six times as likely to retain those customers, and 19 times as likely to be profitable as a result.”

In this sense, banks are in a privileged position compared to actors from other sectors. Next to basic customer information, such as name, age and occupation, they also have data on customers’ spending habits and income.

Banks can use this data to create valuable insights about their customers and, as a result, create more personalized products to meet their clients’ unique needs.

All of this means happier customers, and therefore better levels of retention and more revenue.

Open banking and data in the banking sector

While open banking started as a way of encouraging competition within the payments and banking sector, its inception has led to a new range of products and services being created. Next to this, PSD2 established a new set of standards for payment providers, including regulation surrounding customer authentication.

What does this mean? As long as customers consent, banks are now forced to share their data with third-party providers (TPPs).

This decision overhauled the entire financial world. In the grand scheme of things, it means that banks aren’t the only ones who can provide their customers with financial products. The payments world has opened up to fintechs as well, largely due to these regulation changes and the new data available to them. Because of this, there is more competition in the market than ever before, meaning banks must really up their game to retain their client base.

By having a strong CX they will be able to stay relevant and deliver their customers the best services for their needs.

The hyper-personalized customer experience

Open banking-driven increased competition has led to the proliferation of hyper-personalized customer experiences, created by traditional players like banks, as well as new industry entrants, such as fintechs and challenger banks.

And whether all this data is being used to create new products or to improve existing ones, the customer experience is benefiting.

According to the NPS, customized journeys more than double customer satisfaction when compared with generic experiences. Next to increasing customer loyalty, happy customers are naturally inclined to recommend valuable services to a friend. Therefore, hyper-personalized customer experiences made possible by data, not only encourage customer retention, but increase revenue streams.

Challenges with data

While data can help organizations create a great CX, there’s a dark side we shouldn’t overlook. According to Gartner, poor “dirty data” can cost organizations an average of $15 million yearly in losses.

Managing large amounts of data is not the only struggle banks face, there are very real data protection and cybersecurity concerns for both banks and customers. While banks are responsible for protecting their customers’ data, cybersecurity threats are only on the increase. For this reason, there are strict government regulations in place that banks need to comply with, to ensure consumer protection regarding how client information is not only tracked, but furthermore used by financial institutions.

The future of CX

The facts are in! Data-driven banking is not just a nice-to-have anymore, but an essential when creating a strong CX. Customized solutions encourage customer loyalty and satisfaction, which promotes client retention – something all financial institutions are after.

However, before banks can use data to create better customer journeys and reap the subsequent rewards, they need to put in place a system that can effectively leverage the data to create insights, as well as keeping their customers’ data safe.

For this reason, many choose to partner with fintechs to help them better process the large amounts of data they have at their disposal in a way that’s secure and in line with the latest regulations.

In this way, banking services can provide customers with tailored, customized solutions to best fit their financial needs. In any case, the customer is bound to win. With banks and fintechs competing to produce the best customer experience, customers have more choice than ever before to select a provider that best understands their unique needs.