A series of open banking use cases

Technology disruption, new regulations, consumer shifts and the impact of the global pandemic are driving rapid change in the financial services sector. In particular, open banking is at the forefront of the industry’s evolution, as both a disruptor and a vehicle of opportunity for all participants.

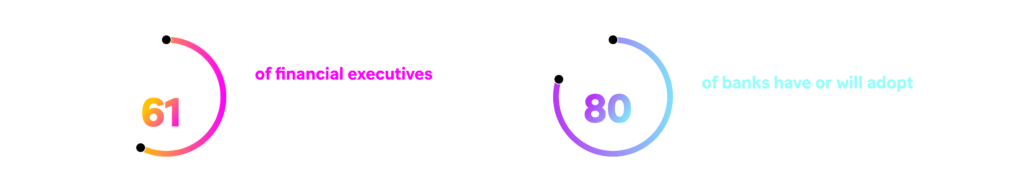

And open banking’s stock is growing fast. According to a KPMG survey, 61 percent of financial executives feel more positive toward it than they did one year ago, and 80 percent of banks have or will adopt open banking solutions.

However, question marks still remain over open banking. Indeed, one survey showed that 46 percent of financial executives don’t feel open banking was widely understood within their organization. Given this uncertainty, we’ve put together a series of articles highlighting different use cases enabled by open APIs and the benefits they offer to both end-customers and financial institutions.

A new landscape

Since the start of the pandemic, remittance flows have come under threat. The situation around the world has brought financial difficulties to migrants and those who work abroad. Many have lost their jobs or had income sources reduced, which in turn has led to fewer remittances. Indeed, according to World Bank’s Migration and Development Brief, remittance flows to low and middle-income countries (LMICs) are projected to fall by 7.5 percent to $470 billion in 2021.

An uncertain economic future is one challenge. Another is the fact that international transfer fees remain high. For instance, the average transfer cost to and within Africa is 8.6 percent. The pandemic also affected remittance processes as banks had to reduce physical branch access due to infection concerns.

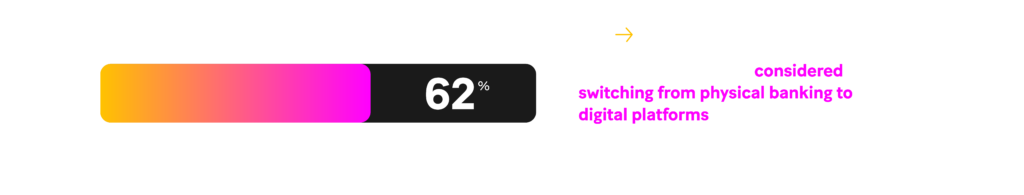

As a result of a crisis, customers were forced to use digital banking services, creating a surge in adoption essentially overnight. And the trend away from physical branches toward digital channels is likely to be permanent. According to Mastercard’s European evolution of banking study, 62 percent of banking customers considered switching from physical banking to digital platforms in 2020.

Open banking + remittance

Given these conditions, financial institutions need to focus on improving remittance cash flow and helping customers weather the storm. And to do this with maximum effect, they need to leverage all relevant and available customer data to make processes faster, easier and less expensive. Open banking-powered remittance allows financial institutions to support their diaspora customers with fundamentally better services.

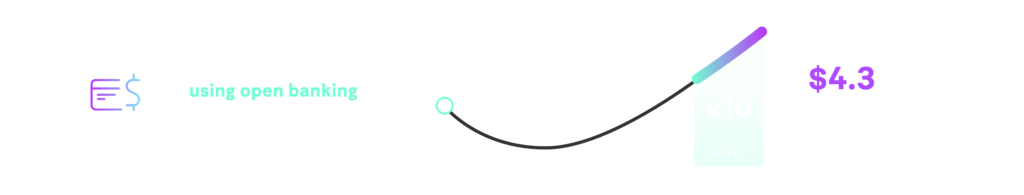

And many FIs are already taking advantage. According to OBIE’s 2020 Round-up, last year, $4.3 million of payments were made using open banking, almost ten times more than in 2019. By leveraging account aggregation and multicurrency payment initiation services, banks can reduce the cost of money transfers, simplify the customer experience (CX) and increase the speed of the remittance process.

At the same time, users can enjoy a comprehensive overview of their local and EU accounts and receive personalized advice. And the potential benefits don’t end there.

Customer experience

Open banking-powered remittance turns the customer experience into a seamless digital process, allowing banks to provide faster access to the funds and improve cash flow. It also ensures that users are kept in the loop with real-time updates on their transfers.

By combining open banking remittance capabilities with predictive suggestions, banks can also strengthen their customer loyalty. Along with streamlined operations, the current health crisis shows that customers expect financial advice and recommendations based on their unique circumstances. According to a recent EPSILON report, 89 percent of consumers are more likely to do business with a bank that offers such an experience.

Transaction costs

By utilizing an open banking remittance solution, financial institutions can improve perhaps the most important aspect: cost. Users can be exempt from extra fees, for instance, amendment charges or other hidden charges. Banks can also gain greater efficiency with aggregate pre-analyzed customer information and assess this data automatically.

In addition, automatization of all processes allows them to reduce manual workloads that are often prone to errors. According to one estimate, around 50 percent of remittance costs can be cut using mobile and open banking technology.

Process speed

Currently, using a traditional approach to transfer money can take up to a few days, while financial institutions that integrate an open banking solution can do it considerably faster. This is because, by being a participant in the open banking ecosystem, FIs can provide a more intuitive user interface, automated forms and faster transaction finality.

Open banking solutions also make it easier to track transfers. A particularly important point because — according to the Mastercard UK state of pay report — 68 percent of consumers would like to be able to see, up to the minute, where their money is.

Leveraging open data

Using an open banking-enabled solution allows financial institutions to access the permissioned financial data of their users. And from this information, banks can glean a better understanding of customers’ economic behavior and needs, which translates to better CX.

This is important for many reasons, none the least of which is that the health crisis has reemphasized the need for financial institutions to embrace change. Being part of an open banking ecosystem is critical to not only offer a competitive remittance product but in creating the contextual experiences customers expect and, ultimately, boosting revenue across the entire enterprise.

Check out our articles on digital lending, PFM, and multi-banking use cases from the same series. And click here to find out how we can help your organization meet its open banking needs.