In conjunction with our sister company, cxpartners, Sopra Banking Software conducted a deep dive into personalized onboarding journeys to better understand how customization affects the propensity to buy.

In part one of this series, we dissected the impact of hyper-personalized onboarding journeys and demonstrated that it affects conversion. In part two, we’ll dig deeper, examining how to further maximize acquisition by leveraging data throughout the acquisition journey from media spend to sales.

Digital marketing is a significant budget item for all financial institutions, and the competition for new customers is more intense than ever. It is estimated that the UK financial industry alone spends close to £2bn on digital marketing a year, creating high customer acquisition expectations.

The problem is that digital financial services marketing lacks the agility to capitalize on market opportunities. There’s also a lack of transparency in the end-to-end acquisition journey coupled with a gap of accountability between marketing and digital product owners. And this leads to financial institutions leaving money on the table.

A competitive landscape

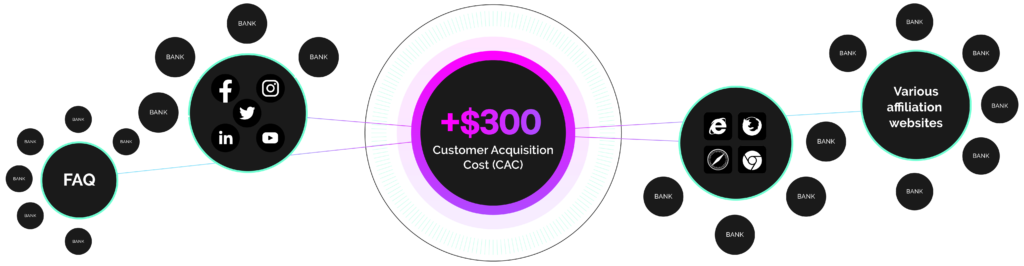

Banks compete by bidding on display ad space in social networks, search engines, forums, FAQs and various affiliation websites. Most benchmarks say that the average customer acquisition cost (CAC) for the banking sector is above $300, a figure which has been rising due to the negative effects of Covid-19 and saturation of digital channels.

Another issue is that managing digital marketing spend is more complex than traditional marketing channels. And the digital marketing budgets are not controlled by the same teams in most places, making it even harder to track end-to-end efficiency.

Most spending relates to traffic with the hope that this will turn into a customer acquisition that looks like the segments banks are trying to attract. Financial institutions craft digital marketing messages based on elaborate customer strategy, which rarely gets transferred to the onboarding journey. They also provide huge referral rewards for existing customers

But all too often, these strategies are not easily mapped to a customer acquisition segment. In addition, analyses are often done retrospectively (if at all), leaving little space to react or readjust to market conditions. All of this puts banks at the mercy of the big players who control traffic.

Of course, there are many firms proposing marketing suite toolkits, with guarantees that they will deliver the promised land of optimized marketing dollars. But in terms of banking, these almost always stop at delivering traffic to product pages.

Why? Because customer acquisition in banking is not as straightforward as purchasing a book on Amazon. It’s subject to KYC, credit data and fraud checks before a customer is properly onboarded.

In this sense, some banks have successfully kept stride with the tech giants. For example, the Bank of Ireland merged both online and offline data, creating a singular, comprehensive account of customer information to inform marketing efforts, resulting in a 278 percent increase in applications the bank received from digital channels. But to some degree, this type of result is an outlier, and many banks have been far less successful.

Ecosystem and artificial Intelligence

Financial institutions lack the ability to categorize prospects, meaning that drop-out rates are higher than they could be, and improper targeting is a real concern. It’s a challenge to track marketing campaigns and digital channels in real-time. Performance reports are often, at best, delivered at the end of a campaign. This results in the inability to switch volume or allocate resources to more successful channels on the fly.

With this in mind, Sopra Banking Software interviewed leaders across the banking industry to identify the top digital marketing pain points. We identified three main blockers:

∙ A lack of integration between marketing suite tools and financial platforms

∙An overly complex ecosystem of marketing and digital marketing tools, i.e. bidding algorithms

∙The speed (and volume) at which data is changing is too fast for humans to analyze it in real-time

To tackle these problems, banks should flip things around. Instead of starting from the marketing toolkit and paid traffic budget, they need to concentrate on the customer acquisition first and then connect the right ecosystem around that. AI-powered tools that can crunch complex data from relevant sources — such as marketing and offline onboarding data — and make inflight recommendations to optimize spend based on the acquisition of the right customer are also needed.

Final thoughts

The first step in the customer journey is the most important, and all financial organizations have the historical data to improve it. This data can be utilized for predictive marketing programs and consumer targeting to offer more tailored ads and content funnels based on specific customer information. And by delivering more individualized marketing, banks can boost engagement, increase conversions and ensure greater consistency across channels.

It’s important that financial firms work to consolidate their technology and map out a framework for disparate systems to derive the most from their data. While it takes time to deploy technology and make the most of data sources, there’s never been a stronger imperative to act.