In conjunction with our sister company, cxpartners, Sopra Banking Software conducted a deep dive into personalized onboarding journeys to better understand how customization affects the propensity to buy.

Over the past decade, banks have deployed customized offers, such as micro-segmentation and packaged products, to maintain their competitive advantage. Yet, compared to companies like Amazon, Google and Netflix, it’s clear that the financial services sector is lagging when it comes to customer experience (CX).

How these companies use data to create a hyper-personalized digital experience is largely unmatched in banking. Many fintechs have recognized this and zeroed in on sleek, data-driven experiences, presenting a direct challenge to some banks. The fact is, a business-as-usual approach in respect to sales and application processes runs the risk of leaving some customer segments neglected.

Beyond segmentation

Banks serve a wide range of customers. Some have high levels of financial literacy and technological competence, others don’t. And although personalized marketing has come a long way, many banks still lack a hyper-personal experience that extends through the decision-making stage to acquire customers.

In the past, a bank manager or teller would’ve met with a customer face-to-face and modulated their approach accordingly; but now, all too often, customers interact with an application that offers a uniform experience regardless of who they are. This equates to missed opportunities to grow a customer base, develop brand loyalty and target customers with relevant offers.

With this in mind, our testing focused on the acquisition of new customer journeys and was intended to test the hypothesis that the end-to-end personalization of onboarding journeys is directly connected with customers’ likelihood of buying.

Breaking down customer personas

Our research was centered on customer journeys for a savings product co-designed with people in two persona categories. Each persona had a variety of differentiating factors and unique needs.

Persona one

A person in “vulnerable” financial circumstances. Persona one is approaching middle age, has irregular work hours, deals with economic uncertainty, has low confidence in their financial knowledge and does everything on their phone.

Persona two

A “digital native”. Persona two recently graduated from university, is fluent in technology, uses social media frequently, has some student loan debt, is interested in new technology and is happy to share their data.

Our testing evaluated how each of these personas would react to different types of onboarding journeys, keeping the marking, data captured and the product features identical throughout the test. Only the onboarding journeys were personalized. The testing also included a generic control experience compared to a custom experience based on common issues each persona might run into and design interventions to preempt them.

For the vulnerable group, the interventions included account suggestion questionnaires, demographic-specific voice and tone, product detail carousels and easy access to customer service buttons. And for digital natives, the interventions were areas such as automated form filling, marketing for mobile features, digital identity verification, and a quick calculator and product chooser. Each journey used language, steps and creative assets personalized to the personas.

The power of customization

Our results showed that, by significant margins, the customized journeys outperformed the control. To assess the effect of personalization on buying behavior, we used perceived usability and satisfaction as a proxy for conversion. To achieve this, we looked at two primary indicators:

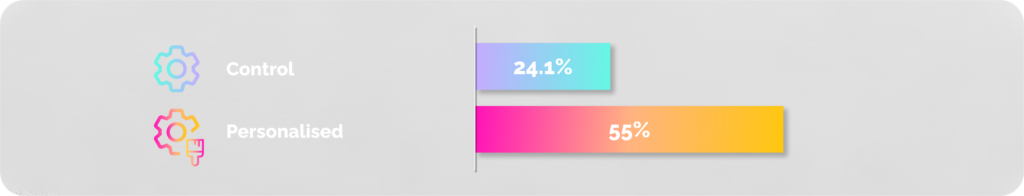

Net Promoter Score (NPS)

The Net Promoter Score – a percentage of customers rating their likelihood to recommend a company, a product, or a service to a friend or colleague – is widely considered a reliable indicator. According to the NPS, customized journeys more than doubled customer satisfaction. For the personalized journey, there was a 30.9 point increase versus the control.

In the real world, this type of change could represent a major increase in the number of users who would complete an application, as well as a higher chance that those users would develop a positive view of the bank’s brand.

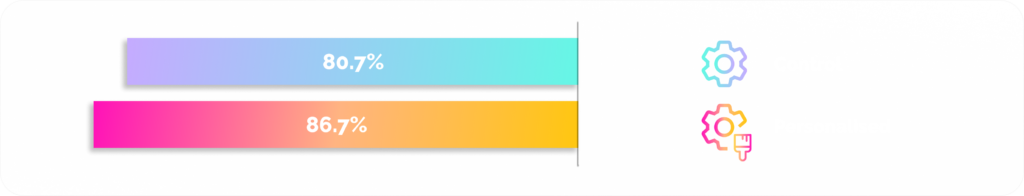

System Usability Scale (SUS)

The system usability scale, which is perhaps the best-known UX questionnaire, showed similar preference for customized journeys, albeit by a smaller margin. In total, there was a 6 point increase for personalized journeys versus the control.

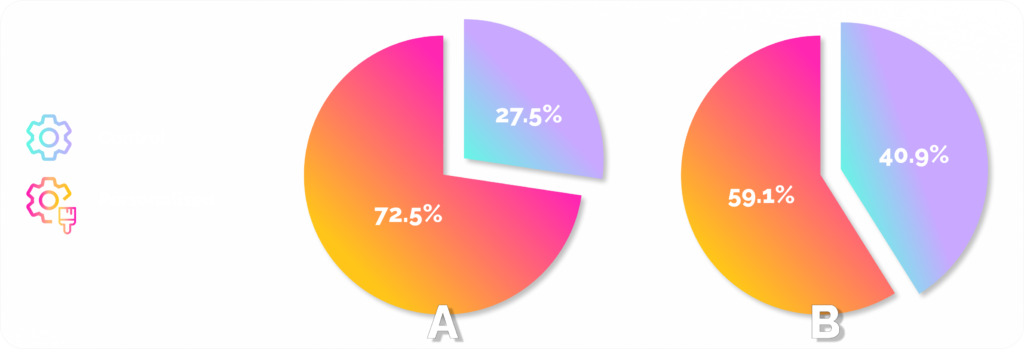

We also assessed the stated preference of our users, which was also notably positive on the personalized journey. In this case, the order of the tests did have an effect on preference, but the customized journey was still a clear favorite for most users.

Final thoughts

On all three measures – SUS, NPS and stated preference – users showed a strong inclination toward the personalized experience. This is hard evidence for what common sense tells us — personalizing onboarding journeys can make or break a bank’s relationship with customers and significantly deliver higher commercial return.

Clearly, personalized experiences have become an imperative. Ubiquitous smart devices, rapidly-evolving CX standards and real-time data processing have raised the bar. The gap between rigid rules-based segmentation and predictive personalization is increasingly noticeable.

Today, customization is about far more than lumping people into demographic groupings. It’s about using real-time data to generate insights and deliver products and services that are context-specific and relevant to customer needs. It’s also about predicting latent needs. And it’s the banks that are quickest to deliver this type of hyper-personal, end-to-end experience that will enjoy a significant competitive advantage going forward.

Keep an eye out for the next article in this series, where we’ll dive deeper into how we use digital data to deliver personalized onboarding journeys.