Digital advances have pushed the banking sector to adapt to new consumer demands, but more than anything, they have highlighted the major disparities weakening the financial ecosystem. Today, banking inclusion is at the center of public debate. While 92 percent of French interviewees in 2011 felt that technology could help banks improve relationships with their clients, it must be noted that differences persist in 2021.

At the time of this survey ten years ago, fintechs did not have as much impact as they do today, having expanded after the 2007 financial crisis. Since the beginning of the current crisis, we have observed their strong contribution to accelerating the changes expected by consumers, leading to questions about the future of the banking sector and the roles its stakeholders will play.

For the past few months, the subject of the democratization of finance has been making the rounds again. The difference is that the simple reflections of ten years ago seem to be giving rise to concrete actions today.

A worrying finding

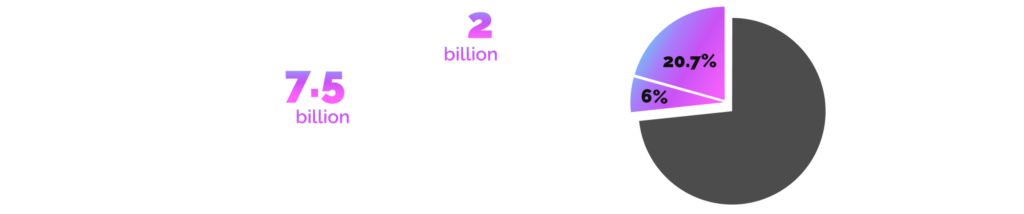

According to a McKinsey report, in 2017, two billion people lived outside the financial system. Although there are multiple reasons behind these figures, there are two main causes: high costs and the location of physical branches.

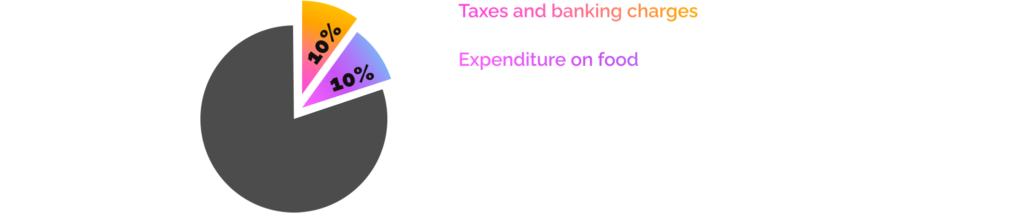

In the most unstable regions of the world, such as the Middle East and Sub-Saharan Africa, more than 450 million adults, or 75 percent of the population, do not have access to basic financial services such as cashing a check, transferring money or even withdrawing cash. This is because they live too far from their bank branches and do not have the means to get there easily. It is also estimated that underprivileged populations spend nearly 10 percent of their income on bank fees, a percentage that is all the more worrying when we know that they spend the same amount on food.

Until recently, financial institutions were at an impasse. On the one hand, they had to respect their customers’ affinity for traditional banking. On the other, they were being pushed to innovate to incorporate populations living outside the system. But the trend now seems reversed. The health crisis has disrupted habits and everything, or almost everything, is now online. This major upheaval has forced banks to reconsider their offerings and rethink their strategies.

Reinventing finance

Therefore, the democratization of finance is the result of a global demand to completely rethink the financial system to make it more accessible to everyone, regardless of consumers’ standards of living, income or geographic location. The first step is getting to know these consumers better.

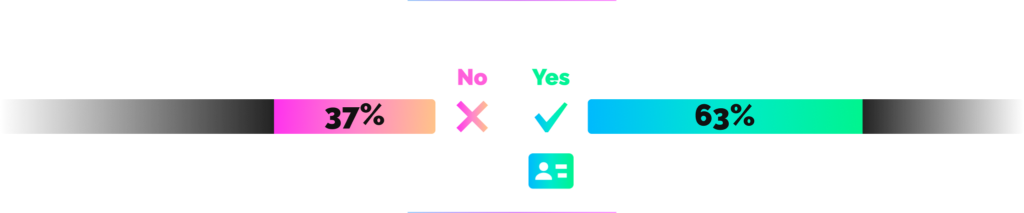

Thanks to the PSD2 regulation, open banking is at the heart of all these issues. The reform facilitates the circulation of personal information and aims above all to allow consumers to choose whether to share data with third parties. The goal is to improve the customer experience by offering a personalized response to their requests. A study conducted by CGI in 2017 also demonstrated that 63 percent of consumers would like to receive personalized offers, even if that means making their personal information accessible to external firms.

Open banking thus appears to be the missing link in the chain, connecting consumers with their increasing demands for financial democratization.

For fintechs, PSD2 is a great deal because it gives them access to valuable data allowing them to create client profiles. This is how Robinhood or TransferWise, for example, came to light. Available on a smartphone and not requiring travel, these new applications make it easy to manage money and services while significantly reducing the costs associated with a physical card or checkbook, along with national and international transfers.

While fintechs are indeed creative, especially when it comes to attracting new customers, they also lack experience and longevity in the market. Traditional banks, on the other hand, have built their reputations over the years.

By working directly with fintechs, banks could ensure that they do not lose their position as leaders in a market where more competitors enter every day. Fintechs, meanwhile, could benefit from the information that banks collect to better identify different consumer profiles and build personalized responses to their requests. As it turns out, this type of collaboration already exists. La Banque Postale, for example, acquired capital in WeShareBonds in 2016. This fintech specializing in participatory credit financing gave French SMEs access to new sources of financing.

Banks are not the only ones to partner with fintechs to boost their offerings. Software publisher and Sopra Banking’s parent company, Sopra Steria, recently acquired a stake in Particeep, a French fintech that publishes SaaS solutions for the online marketing of banking, insurance and savings products. These solutions aim to provide customers with a native, turnkey solution to help them subscribe to financial products. By integrating Particeep’s solutions with Sopra Banking’s software, the collaboration’s objective is to democratize the digital sale of banking products by opening the finance market in France and abroad.

Learn more about this collaboration by reading the article on Particeep’s blog, which addresses the current challenges of the financial market and the benefits of teamwork.

Innovation through collaboration

The future is already playing out today. The Covid-19 crisis accelerated previously initiated changes, and it is no longer enough to plan a digital approach and loyalty strategies. The democratization of finance is an important topic because it goes beyond the simple banking framework and challenges the thinking on inclusion, transparency and security.

As competition increases, traditional banks must equip themselves with the best available tools and surround themselves with partners likely to make a difference to consumers. The key, therefore, lies in this stimulating environment, where success is synonymous with collaboration.